Page 292 - BCML AR 2019-20

P. 292

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

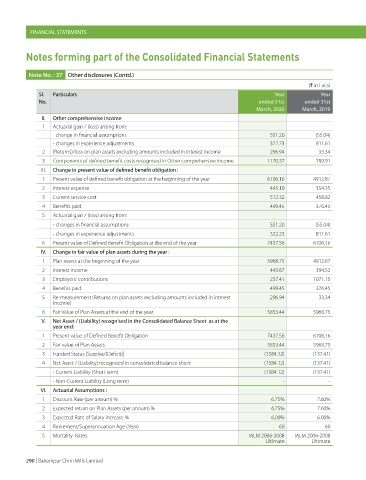

Note No. : 37 Other disclosures (Contd.)

(` in Lacs)

Sl. Particulars Year Year

No. ended 31st ended 31st

March, 2020 March, 2019

II. Other comprehensive income

1 Actuarial gain / (loss) arising from:

- change in financial assumptions 551.20 (55.04)

- changes in experience adjustments 322.23 811.61

2 (Returns)/loss on plan assets excluding amounts included in interest income 296.94 33.34

3 Components of defined benefit costs recognised in Other comprehensive income 1170.37 789.91

III. Change in present value of defined benefit obligation :

1 Present value of defined benefit obligation at the beginning of the year 6106.16 4912.87

2 Interest expense 445.10 354.35

3 Current service cost 512.32 458.82

4 Benefits paid 499.45 376.45

5 Actuarial gain / (loss) arising from:

- changes in financial assumptions 551.20 (55.04)

- changes in experience adjustments 322.23 811.61

6 Present value of Defined Benefit Obligation at the end of the year 7437.56 6106.16

IV. Change in fair value of plan assets during the year :

1 Plan assets at the beginning of the year 5968.75 4912.87

2 Interest income 443.67 394.52

3 Employers' contributions 237.41 1071.15

4 Benefits paid 499.45 376.45

5 Re-measurement (Returns on plan assets excluding amounts included in interest 296.94 33.34

income)

6 Fair Value of Plan Assets at the end of the year 5853.44 5968.75

V. Net Asset / (Liability) recognised in the Consolidated Balance Sheet as at the

year end:

1 Present value of Defined Benefit Obligation 7437.56 6106.16

2 Fair value of Plan Assets 5853.44 5968.75

3 Funded Status [Surplus/(Deficit)] (1584.12) (137.41)

4 Net Asset / (Liability) recognised in consolidated balance sheet (1584.12) (137.41)

- Current Liability (Short term) (1584.12) (137.41)

- Non-Current Liability (Long term) - -

VI. Actuarial Assumptions :

1 Discount Rate (per annum) % 6.75% 7.60%

2 Expected return on Plan Assets (per annum) % 6.75% 7.60%

3 Expected Rate of Salary increase % 6.00% 6.00%

4 Retirement/Superannuation Age (Year) 60 60

5 Mortality Rates IALM 2006-2008 IALM 2006-2008

Ultimate Ultimate

290 | Balrampur Chini Mills Limited