Page 293 - BCML AR 2019-20

P. 293

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

Sl. Particulars Year Year

No. ended 31st ended 31st

March, 2020 March, 2019

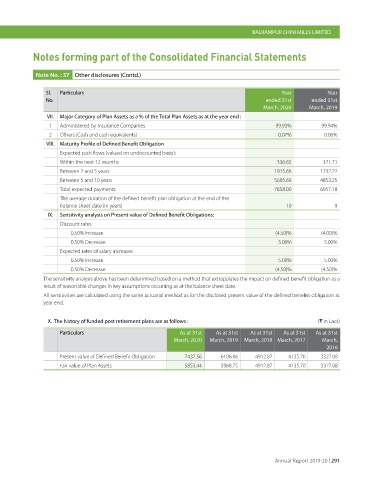

VII. Major Category of Plan Assets as a % of the Total Plan Assets as at the year end :

1 Administered by Insurance Companies 99.93% 99.94%

2 Others (Cash and cash equivalents) 0.07% 0.06%

VIII. Maturity Profile of Defined Benefit Obligation

Expected cash flows (valued on undiscounted basis):

Within the next 12 months 336.65 371.71

Between 2 and 5 years 1915.66 1732.22

Between 5 and 10 years 5605.69 4853.25

Total expected payments 7858.00 6957.18

The average duration of the defined benefit plan obligation at the end of the

balance sheet date (in years) 10 9

IX. Sensitivity analysis on Present value of Defined Benefit Obligations:

Discount rates

0.50% Increase (4.50)% (4.00)%

0.50% Decrease 5.00% 5.00%

Expected rates of salary increases

0.50% Increase 5.00% 5.00%

0.50% Decrease (4.50)% (4.50)%

The sensitivity analysis above has been determined based on a method that extrapolates the impact on defined benefit obligation as a

result of reasonable changes in key assumptions occurring as at the balance sheet date.

All sensitivities are calculated using the same actuarial method as for the disclosed present value of the defined benefits obligation at

year end.

X. The history of funded post retirement plans are as follows : (` in Lacs)

Particulars As at 31st As at 31st As at 31st As at 31st As at 31st

March, 2020 March, 2019 March, 2018 March, 2017 March,

2016

Present value of Defined Benefit Obligation 7437.56 6106.16 4912.87 4135.70 3327.08

Fair value of Plan Assets 5853.44 5968.75 4912.87 4135.70 3327.08

Annual Report 2019-20 | 291