Page 294 - BCML AR 2019-20

P. 294

FINANCIAL STATEMENTS

Notes forming part of the Consolidated Financial Statements

Note No. : 37 Other disclosures (Contd.)

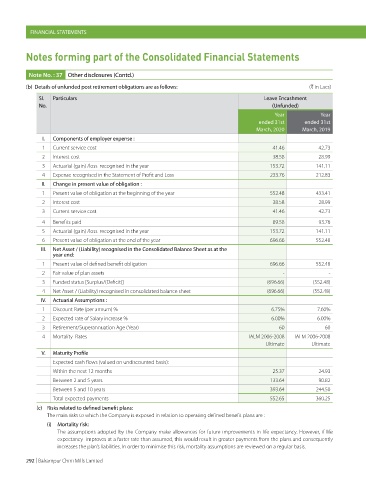

(b) Details of unfunded post retirement obligations are as follows: (C in Lacs)

Sl. Particulars Leave Encashment

No. (Unfunded)

Year Year

ended 31st ended 31st

March, 2020 March, 2019

I. Components of employer expense :

1 Current service cost 41.46 42.73

2 Interest cost 38.58 28.99

3 Actuarial (gain) /loss recognised in the year 153.72 141.11

4 Expense recognised in the Statement of Profit and Loss 233.76 212.83

II. Change in present value of obligation :

1 Present value of obligation at the beginning of the year 552.48 433.41

2 Interest cost 38.58 28.99

3 Current service cost 41.46 42.73

4 Benefits paid 89.58 93.76

5 Actuarial (gain) /loss recognised in the year 153.72 141.11

6 Present value of obligation at the end of the year 696.66 552.48

III. Net Asset / (Liability) recognised in the Consolidated Balance Sheet as at the

year end:

1 Present value of defined benefit obligation 696.66 552.48

2 Fair value of plan assets - -

3 Funded status [Surplus/(Deficit)] (696.66) (552.48)

4 Net Asset / (Liability) recognised in consolidated balance sheet (696.66) (552.48)

IV. Actuarial Assumptions :

1 Discount Rate (per annum) % 6.75% 7.60%

2 Expected rate of Salary increase % 6.00% 6.00%

3 Retirement/Superannuation Age (Year) 60 60

4 Mortality Rates IALM 2006-2008 IALM 2006-2008

Ultimate Ultimate

V. Maturity Profile

Expected cash flows (valued on undiscounted basis):

Within the next 12 months 25.37 24.93

Between 2 and 5 years 133.64 90.82

Between 5 and 10 years 393.64 244.50

Total expected payments 552.65 360.25

(c) Risks related to defined benefit plans:

The main risks to which the Company is exposed in relation to operating defined benefit plans are :

(i) Mortality risk:

The assumptions adopted by the Company make allowances for future improvements in life expectancy. However, if life

expectancy improves at a faster rate than assumed, this would result in greater payments from the plans and consequently

increases the plan’s liabilities. In order to minimise this risk, mortality assumptions are reviewed on a regular basis.

292 | Balrampur Chini Mills Limited