Page 32 - NSAA_Winter_2017_WEB

P. 32

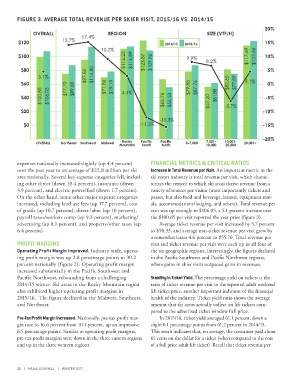

FIGURE 3. AVERAGE TOTAL REVENUE PER SKIER VISIT, 2015/16 VS. 2014/15

20%

OVERALL 17.4% REGION SIZE (VTF/H)

$120 15.7% 2014/15 2015/16 15%

10.2%

$112.23 $116.89 $123.87 $109.86 8.2%

$100 9.9% $117.69 $123.66 10%

$80 5%

5.1% $97.82 $114.80

$60 $77.70 $89.89 $71.86 $79.19 $79.83 $87.76 $82.60 $77.89 5.1% 0%

$100.85 $106.03 4.1%

$40 $66.76 $56.53 $57.20 $61.88 -5%

$20 -5.7% -10%

-15.3%

-15.3%

$0 -11.3% -15%

-20%

7,501-

Rocky

OVERALL Northeast Southeast Midwest Mountain Pacific Pacific 0-7,500 10,000 10,001- 20,001+

North

20,000

South

expenses nationally increased slightly (up 4.4 percent) FINANCIAL METRICS & CRITICAL RATIOS

over the past year to an average of $22.8 million per ski Increase in Total Revenue per Visit. An important metric in the

area nationally. Several key expense categories fell, includ- ski resort industry is total revenue per visit, which charac-

ing other direct (down 10.4 percent), insurance (down terizes the ezxtent to which ski areas derive revenue from a

3.9 percent), and electric power/fuel (down 1.7 percent). variety of sources per visitor (most importantly tickets and

On the other hand, some other major expense categories passes, but also food and beverage, lessons, equipment rent-

increased, including land use fees (up 17.7 percent), cost als, accommodations/lodging, and others). Total revenue per

of goods (up 10.7 percent), direct labor (up 10 percent), visit was up strongly to $106.03, a 5.1 percent increase over

payroll taxes/workers comp (up 9.3 percent), marketing/ the $100.85 per visit reported the year prior (figure 3).

advertising (up 8.1 percent), and property/other taxes (up Average ticket revenue per visit increased by 5.7 percent

6.4 percent). to $50.33, and average non-ticket revenue per visit grew by

a somewhat lesser 4.6 percent to $55.70. Total revenue per

PROFIT MARGINS visit and ticket revenue per visit were each up in all four of

Operating Profit Margin Improved. Industry wide, operat- the six geographic regions; interestingly, the figures declined

ing profit margin was up 2.8 percentage points to 30.2 in the Pacific Southwest and Pacific Northwest regions,

percent nationally (figure 2). Operating profit margin where gains in skier visits outpaced gains in revenues.

increased substantially in the Pacific Southwest and

Pacific Northwest, rebounding from a challenging Stability in Ticket Yield. The percentage yield on tickets is the

2014/15 winter. Ski areas in the Rocky Mountain region ratio of ticket revenue per visit to the reported adult weekend

also exhibited higher operating profit margins in lift ticket price, another important indicator of the financial

2015/16. The figure declined in the Midwest, Southeast, health of the industry. Ticket yield ratio shows the average

and Northeast. amount that ski areas actually collect on lift tickets com-

pared to the advertised ticket window full price.

Pre-Tax Profit Margin Increased. Nationally, pre-tax profit mar- In 2015/16, ticket yield averaged 61.1 percent, down a

gin rose to 16.6 percent from 10.1 percent, up an impressive slight 0.1 percentage points from 61.2 percent in 2014/15.

6.5 percentage points. Similar to operating profit margins, This result indicates that, on average, the consumer paid about

pre-tax profit margins were down in the three eastern regions 61 cents on the dollar for a ticket (when compared to the cost

and up in the three western regions. of a full price adult lift ticket). Recall that ticket revenue per

30 | NSAA JOURNAL | WINTER 2017