Page 130 - AR DPBM-2016--SMALL

P. 130

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

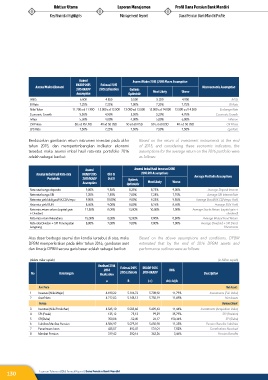

Asumsi Asumsi Makro 2016 | 2016 Macro Assumption

Estimasi 2015

Asumsi Makro Ekonomi RKADP 2015 2015 Estimation Optimis Macroecnomic Assumption

2015 RKADP

Assumption Optimistic Most Likely Worse

IHSG 6.000 4.850 5.500 5.350 4.900 IHSG

BI Rate 7,25% 7,25% 7,00% 7,25% 7,75% BI Rate

Nilai Tukar 11.700 s.d 11.900 13.000 s.d 13.500 13.000 sd 13.500 13.000 s.d 14.000 13.500 s.d 14.500 Exchange Rate

Economic Growth 5,50% 4,90% 5,50% 5,20% 4,70% Economic Growth

Inflasi 5,50% 4,00% 4,00% 5,00% 6,00% Inflation

Oil Prices 80 s.d 95 USD 40 sd 50 USD 50 sd 60 USD 50 s.d 60 USD 40 s.d 50 USD Oil Prices

LPS Rate 7,50% 7,25% 7,50% 7,50% 7,50% Lps Rate

Berdasarkan gambaran return instrumen investasi pada akhir Based on the return of investment instruments at the end

tahun 2015, dan mempertimbangkan indikator ekonomi of 2015, and considering these economic indicators, the

tersebut maka asumsi imbal hasil rata-rata portofolio 2016 assumptions for the average return on the 2016 portfolio were

adalah sebagai berikut: as follows:

Asumsi Asumsi Imbal Hasil Investasi 2016

Asumsi Imbal Hasil Rata-rata RKADP 2015 Okt-15 2016 ROI Assumptions Average Portfolio Assumptions

Portofolio 2015 RKADP Oct 15 Optimis

Assumption Optimistic Most Likely Worse

Rata-rata bunga deposito 9,00% 9,50% 8,25% 8,75% 9,00% Average Deposit Interest

Rata-rata bunga SBI 7,25% 7,50% 7,00% 7,25% 7,75% Average SBI Interest Rate

Rata-rata yield obligasi/KIK EBA/repo 9,00% 10,00% 9,00% 9,25% 9,50% Average Bond/KIK EBA/repo Yield

Rata-rata yield SUN 8,50% 9,00% 8,00% 8,25% 8,50% Average SUN Yield

Rata-rata return saham (capital gain 17,50% 0,00% 13,00% 10,00% 1,00% Average Stocks Return (capital gain +

+ Dividen) dividend)

Rata-rata return Reksadana 15,00% 0,00% 12,00% 9,00% 0,50% Average Mutual Fund Return

Rata-rata Dividen + SPI Penempatan 8,00% 7,00% 9,00% 9,00% 7,00% Average Dividend + SPI Direct

Langsung Placements

Atas dasar berbagai asumsi dan kondisi tersebut di atas, maka Based on the above assumptions and conditions, DPBM

DPBM memperkirakan pada akhir tahun 2016, gambaran aset estimated that by the end of 2016 DPBM assets and

dan kinerja DPBM secara garis besar adalah sebagai berikut: performance outlines were as follows:

(dalam miliar rupiah) (in billion rupiah)

Realisasi 2014 Estimasi 2015 RKADP 2016

2014 ROG

No Keterangan Realization 2015 Estimate 2016 RKADP Description

a B ( c ) d=(c-b)/b

Aset Neto Net Assets

1 Investasi (Nilai Wajar) 4.690,22 5.106,72 5.708,92 11,79% Investments (Fair Value)

2 Aset Neto 4.712,03 5.148,13 5.750,19 11,69% Net Assets

Neraca Balance Sheet

3 Investasi (Nilai Perolehan) 4.565,10 5.033,60 5.609,63 11,44% Investments (Acquisition Value)

4 SPI (Posisi) 125,12 73,12 99,29 35,79% SPI (Position)

5 SPI(Delta) 350,08 -52,00 26,17 150,34% SPI (Delta)

6 Liabilitas Manfaat Pensiun 4.586,92 5.075,01 5.650,90 11,35% Pension Benefits Liabilities

7 Penerimaan Iuran 435,57 492,47 531,01 7,82% Contributions Received

8 Manfaat Pensiun 319,42 350,16 362,26 3,46% Pension Benefits

130 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri