Page 135 - AR DPBM-2016--SMALL

P. 135

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

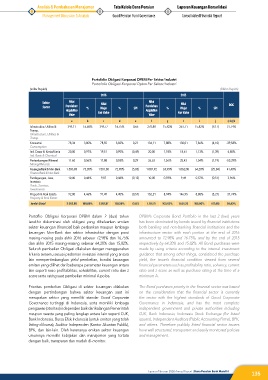

Portofolio Obligasi Korporasi DPBM Per Sektor/Industri

Portofolio Obligasi Korporasi Dpbm Per Sektor/Industri

(miliar Rupiah) (Billion Rupiah)

2016 2015

Sektor Nilai Nilai Nilai Nilai ROG

Sector Perolehan % Wajar % SPI Perolehan % Wajar % SPI

Acquisition Fair Value Acquisition Fair Value

Value Value

a b c d e f g h i j (c-h)/h

Infrastruktur, Utilitas & 344,11 16,68% 344,77 16,75% 0,66 270,88 15,92% 261,71 15,82% (9,17) 31,74%

Transp.

Infrastructure, Utilities &

Transp.

Konsumsi 78,34 3,80% 78,55 3,82% 0,21 134,11 7,88% 130,01 7,86% (4,10) -39,58%

Consumption

Ind. Dasar & Kimia/Kimia 20,00 0,97% 19,51 0,95% (0,49) 20,00 1,18% 18,61 1,13% (1,39) 4,80%

Ind. Basic & Chemical

Pertambangan/Mineral 11.60 0,56% 11,88 0,58% 0,29 26,63 1,56% 25,43 1,54% (1,19) -53,29%

Mining/Minerals

Keuangan/Bank & Non- Bank 1.506,83 73,05% 1.501,80 72,98% (5,03) 1.087,92 63,93% 1.062,08 64,20% (25,84) 41,40%

Finance/Bank & Non Bank

Perdagangan, Jasa, 10,00 0,48% 9,87 0,48% (0,13) 10,00 0,59% 9,49 0,57% (0,51) 3,96%

Investasi

Trade, Services,

Investments

Properti & Real Estate 92,00 4,46% 91,49 4,45% (0,51) 152,21 8,94% 146,95 8,88% (5,27) -37,74%

Property & Real Estate

Jumlah | Total 2.062,88 100,00% 2.057,87 100,00% (5,01) 1,701,75 100,00% 1.654,29 100,00% (47,46) 24,40%

Portoflio Obligasi Korporasi DPBM dalam 2 (dua) tahun DPBM’s Corporate Bond Portfolio in the last 2 (two) years

terakhir didominasi oleh obligasi yang dikeluarkan emiten has been dominated by bonds issued by financial institutions

sektor keuangan (financial) baik perbankan maupun lembaga both banking and non-banking financial institutions and the

keuangan Non-Bank dan sektor infrastruktur dengan porsi infrastructure sector with each portion at the end of 2016

masing-masing pada akhir 2016 sebesar 72,98% dan 16,75% amounted to 72.98% and 16.75%, and by the end of 2015

dan akhir 2015 masing-masing sebesar 64,20% dan 15,82%. respectively by 64.20% and 15.82%. All Bond purchases were

Seluruh pembelian Obligasi dilakukan dengan menggunakan made by using criteria according to the internal investment

kriteria tertentu sesuai pedoman investasi internal yang antara guidance that among other things, considered the purchase

lain mempertimbangkan yield pembelian, kondisi keuangan yield, the issuer’s financial condition viewed from several

emiten yang dilihat dari beberapa parameter keuangan antara financial parameters such as profitability ratio, solvency, current

lain seperti rasio profitabilitas, solvabilitas, current ratio dan z ratio and z score as well as purchase rating at the time of a

score serta rating saat pembelian minimal A polos. minimum A.

Prioritas pembelian Obligasi di sektor keuangan dilakukan The Bond purchases priority in the financial sector was based

dengan pertimbangan bahwa sektor keuangan saat ini on the consideration that the financial sector is currently

merupakan sektor yang memiliki standar Good Corporate the sector with the highest standards of Good Corporate

Governance tertinggi di Indonesia, serta memiliki lembaga Governance in Indonesia, and has the most complete

pengawas (otoritas) independen baik dari kalangan Pemerintah independent government and private authorities including

maupun swasta yang paling lengkap antara lain seperti OJK, OJK, Bank Indonesia, Indonesia Stock Exchange (for listed

Bank Indonesia, Bursa Efek Indonesia (untuk emiten yang telah issuers), Independent Auditors (Public Accounting Firms), BPK,

listing di bursa), Auditor Independen (Kantor Akuntan Publik), and others. Therefore publicly listed financial sector issuers

BPK, dan lain-lain. Oleh karenanya emiten sektor keuangan have well structured, transparent and easily monitored policies

umumnya memiliki kebijakan dan manajemen yang tertata and management.

dengan baik, transparan dan mudah di-monitor.

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

135