Page 131 - AR DPBM-2016--SMALL

P. 131

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

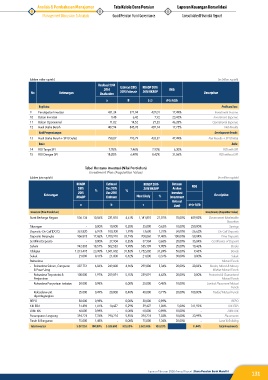

(dalam miliar rupiah) (in billion rupiah)

Realisasi 2014 Estimasi 2015 RKADP 2016

2014 ROG

No Keterangan Realization 2015 Estimate 2016 RKADP Description

a B ( c ) d=(c-b)/b

Rugi Laba Profit and Loss

9 Pendapatan Investasi 431,34 371,94 437,01 17,49% Investment Income

10 Beban Investasi 9,48 6,42 7,92 23,43% Investment Expense

11 Beban Operasional 11,02 14,52 21,23 46,28% Operational Expense

12 Hasil Usaha Bersih 407,94 345,78 407,14 17,75% Net Results

Hasil Pengembangan Development Results

13 Hasil Usaha Bersih + SPI ( Delta) 758,02 293,79 433,32 47,49% Net Results + SPI (Delta)

Rasio Ratio

14 ROI Tanpa SPI 9,95% 7,46% 7,93% 6,30% ROI with SPI

15 ROI Dengan SPI 18,20% 6,40% 8,42% 31,56% ROI without SPI

Tabel Rencana Investasi (Nilai Perolehan)

Investment Plan (Acquisition Value)

(dalam juta rupiah) (in million rupiah)

RKADP Estimasi RKADP 2016 Batasan ROG

2015 % Des 2015 % 2016 RKADP Arahan

Keterangan 2015 Dec 2015 Investasi Description

RKADP Estimate Most Likely % Investment

Referral

a b c Limit d=(c-b)/b

Investasi (Nilai Perolehan) Investments (Acquisition Value)

Surat Berharga Negara 536.134 10,56% 231,810 4,61% 1,181,810 21,07% 70,00% 409,82% Government Marketable

Securities

Tabungan - 0,00% 10,000 0,20% 35,000 0,62% 10,00% 250,00% Savings

Deposito On Call (DOC) 353.820 6,97% 100,300 1,99% 73,600 1,31% 50,00% -26,62% On Call Deposits

Deposito Berjangka 906.825 17,86% 1,700,910 33,79% 700,060 12,48% 100,00% -58,84% Time Deposits

Sertifikat Deposito - 0,00% 27,904 0,55% 37,904 0,68% 20,00% 35,84% Certificates of Deposit

Saham 942.805 18,57% 502,533 9,98% 555,109 9,90% 25,00% 10,46% Stocks

Obligasi 1.213.495 23,90% 1,601,602 31,82% 1,752,602 31,24% 50,00% 9,43% Bonds

Sukuk 21.000 0,41% 21,000 0,42% 21,000 0,37% 30,00% 0,00% Sukuk

Reksadana Mutual Funds

- Reksadana Saham, Campuran 307.751 6,06% 249,800 4,96% 299,800 5,34% 20,00% 20,02% Stocks, Mixed & Money

& Pasar Uang Market Mutual Funds

- Reksadana Terproteksi & 100.000 1,97% 259,091 5,15% 259,091 4,62% 20,00% 0,00% Protected & Guaranteed

Penjaminan Mutual Funds

- Reksadana Penyertaan terbatas 50.000 0,98% - 0,00% 25,000 0,45% 10,00% - Limited Placement Mutual

Funds

- Reksadana unit 25.000 0,49% 20,000 0,40% 40,000 0,71% 20,00% 100,00% Traded Mutual Funds

diperdagangkan

REPO 50.000 0,98% - 0,00% 50,000 0,89% - - REPO

KIK EBA 51.498 1,01% 14,427 0,29% 59,427 1,06% 5,00% 311,93% KIK EBA

DIRE KIK 50.000 0,98% - 0,00% 50,000 0,89% 10,00% - DIRE KIK

Penempatan Langsung 394.224 7,76% 294,224 5,85% 394,224 7,03% 10,00% 33,99% Placements

Tanah & Bangunan 75.000 1,48% - 0,00% 75,000 1,34% 20,00% - Land & Building

Total Investasi 5.077.551 100,00% 5.033.600 100,00% 5.609.626 100,00% 11,44% Total Investments

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

131