Page 139 - AR DPBM-2016--SMALL

P. 139

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

Apabila dirinci secara sektoral dalam 2 (dua) tahun terakhir Itemized on a sectoral basis for the last 2 (two) years was as

sebagai berikut: follows:

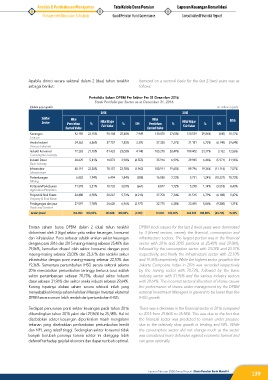

Portofolio Saham DPBM Per Sektor Per 31 Desember 2016

Stock Portfolio per Sector as at December 31, 2016

(dalam juta rupiah) (in million rupiah)

2016 2015

Sektor Nilai Nilai IHSG

Sector Perolehan % Nilai Wajar % SPI Perolehan % Nilai Wajar % SPI

Earned Value Fair Value Earned Value Fair Value

Keuangan 82.155 23,15% 90.104 25,48% 7.949 138.878 27,04% 138.539 29,86% (340) 18,17%

Finance

Aneka Industri 24.362 6,86% 27.757 7,85% 3.395 37.330 7,27% 31.181 6,72% (6.148) 29,64%

Various Industries

Industri Konsumsi 77.283 21,78% 81.423 23,03% 4.140 105.270 20,49% 108.402 23,37% 3.132 12,56%

Consumption Industry

Industri Dasar 20.629 5,81% 14.073 3,98% (6.555) 35.916 6,99% 29.945 6,46% (5.971) 31,96%

Basic Industry

Infrastruktur 80.119 22,58% 78.157 22,10% (1.962) 100.911 19,65% 89.796 19,36% (11.114) 7,57%

Infrastructure

Pertambangan 6.882 1,94% 6.494 1,84% (388) 16.058 3,13% 5.731 1,24% (10.327) 70,73%

Mining

Pertanian/Perkebunan 11.393 3,21% 10.732 3,03% (661) 8.817 1,72% 5.298 1,14% (3.518) 8,43%

Agriculture/Plantation

Properti & Real Estate 24.480 6,90% 20.267 5,73% (4.213) 37.703 7,34% 31.515 6,79% (6.188) 5,47%

Property & Real Estate

Perdagangan dan jasa 27.597 7,78% 24.620 6,96% (2.977) 32.775 6,38% 23.495 5,06% (9.280) 1,31%

Trade and Services

Jumlah | Total 354.899 100,00% 353.628 100,00% (1.272) 513.657 100,00% 463.902 100,00% (49.755) 15,32%

Emiten saham bursa DPBM dalam 2 (dua) tahun terakhir DPBM stock issuers for the last 2 (two) years were dominated

didominasi oleh 3 (tiga) sektor yaitu sektor keuangan, konsumsi by 3 (three) sectors, namely the financial, consumption and

dan infratsruktur. Porsi terbesar adalah emiten sektor keuangan infrastructure sectors. The largest portion was in the financial

dengan porsi 2016 dan 2015 masing-masing sebesar 25,48% dan sector with 2016 and 2015 portions at 25.48% and 29.86%,

29,86%, kemudian disusul oleh sektor konsumsi dengan porsi followed by the consumption sector with 23.03% and 23.37%

masing-masing sebesar 23,03% dan 23,37% dan terakhir sektor respectively, and finally the infrastructure sector with 22.10%

infrastruktur dengan porsi masing-masing sebesar 22,10% dan and 19.36% respectively. While the highest sector growth in the

19,36%. Sementara pertumbuhan IHSG secara sektoral selama Jakarta Composite Index in 2016 was recorded respectively

2016 mencatatkan pertumbuhan tertinggi berturut-turut adalah by the mining sector with 70.73%, followed by the basic

sektor pertambangan sebesar 70,73%, disusul sektor industri industry sector with 31.96% and the various industry sectors

dasar sebesar 31,96% dan sektor aneka industri sebesar 29,64%. with 29.64%. The incorrect sectoral allocation of shares causes

Kurang tepatnya alokasi saham secara sektoral inilah yang the performance of shares under management by the DPBM

menyebabkan kinerja saham kelolaan Manajer Investasi eksternal external Investment Managers in general to be lower than the

DPBM secara umum lebih rendah dari pertumbuhan IHSG. IHSG growth.

Terdapat penurunan porsi sektor keuangan pada tahun 2016 There was a decrease in the financial sector in 2016 compared

dibandingkan tahun 2015 yakni dari 29,86% ke 25,48%. Hal ini to 2015 from 29.86% to 25.48%. This was due to the fact that

disebabkan sektor keuangan diperkirakan masih mengalami the financial sector was predicted to remain under pressure

tekanan yang disebabkan perlambatan pertumbuhan kredit due to the relatively slow growth in lending and NPL. While

dan NPL yang relatif tinggi. Sedangkan sektor konsumsi tidak the consumption sector did not change much as the sector

banyak berubah porsinya karena sektor ini dianggap lebih was considered more defensive against economic turmoil and

defensif terhadap gejolak ekonomi dan dapat tumbuh optimal. can grow optimally.

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

139