Page 138 - AR DPBM-2016--SMALL

P. 138

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

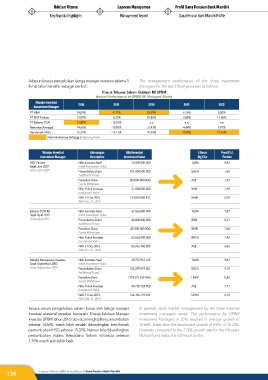

Adapun kinerja pengelolaan ketiga manajer investasi selama 5 The management performance of the three investment

(lima) tahun terakhir sebagai berikut: managers for the last 5 (five) years was as follows:

Kinerja Tahunan Saham Kelolaan MI DPBM

Annual Performance of DPBM MI Managed Stocks

Manajer Investasi 2016 2015 2014 2013 2012

Investment Manager

PT MMI 14,00% -8,11% 32,99% -6,16% 8,08%

PT BNP Paribas 13,09% -8,23% 29,86% -2,80% 11,06%

PT Bahana TCW 16,89% -13,81% n.a n.a n.a

Rata-rata (Average) 14,66% -10,05% 31,43% -4,48% 9,57%

Benchmark IHSG 15,32% -12,13% 20,49% -0,98% 12,55%

Pertumbuhannya tertinggi | Highest growth

Manajer Investasi Keterangan Nilai Investasi 5 Besar Porsi (%)

Investment Manager Description Investment Value Big Five Portion

BNP Paribas Nilai Investasi Awal 33.000.000.000 TLKM 8,83

Sejak Juni 2007 Initial Investment Value

Since June 2007 Penambahan Dana 101.800.000.000 BBCA 7,60

Additional Funds

Penarikan Dana (83.000.000.000) ASII 7,49

Funds Withdrawn

Nilai Pokok Investasi 51.800.000.000 BBRI 7,48

Investment Value

NAV 31 Des 2016 144.803.898.403 BMRI 6,28

NAV Dec 31, 2016

Bahana TCW IM Nilai Investasi Awal 67.863.000.000 TLKM 9,87

Sejak April 2015 Initial Investment Value

Since April 2015 Penambahan Dana 40.000.000.000 BBRI 8,21

Additional Funds

Penarikan Dana (25.000.000.000) BMRI 7,68

Funds Withdrawn

Nilai Pokok Investasi 82.863.000.000 BBCA 7,42

Investment Value

NAV 31 Des 2016 83.676.160.505 ASII 6,65

NAV Dec 31, 2016

Mandiri Manajemen Investasi Nilai Investasi Awal 28.707.967.165 TLKM 9,67

Sejak September 2003 Initial Investment Value

Since September 2003 Penambahan Dana 126.299.997.381 BBCA 9,19

Additional Funds

Penarikan Dana (114.279.839.966) HMSP 8,56

Funds Withdrawn

Nilai Pokok Investasi 40.728.124.580 ASII 7,71

Investment Value

NAV 31 Des 2016 162.362.759.464 UNVR 6,70

NAV Dec 31, 2016

Secara umum pengelolaan saham bursa oleh ketiga manajer In general, stock market management by the three external

investasi eksternal tersebut bervariasi. Kinerja kelolaan Manajer investment managers varies. The performance by DPBM

Investasi DPBM tahun 2016 rata-rata menghasilkan pertumbuhan Investment Managers in 2016 resulted in average growth of

sebesar 14,66%, masih lebih rendah dibandingkan benchmark 14.66%, lower than the benchmark growth of IHSG of 15.32%.

pertumbuhan IHSG sebesar 15,32%. Namun bila dibandingkan However, compared to the 7.70% growth rate for the Infovesta

pertumbuhan Indeks Reksadana Saham Infovesta sebesar Mutual Fund Index it is still much better.

7,70% masih jauh lebih baik.

138 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri