Page 22 - AR DPBM-2016--SMALL

P. 22

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

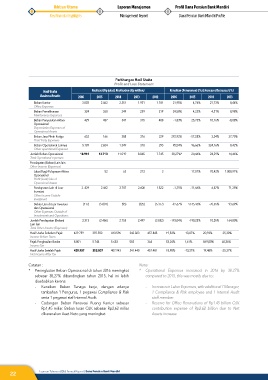

Perhitungan Hasil Usaha

Profit and Loss Statement

Hasil Usaha Realisasi (Rp juta) | Realization (Rp million) Kenaikan (Penurunan) (%) | Increase (Decrease) (%)

Business Results 2016 2015 2014 2013 2012 2016 2015 2014 2013

Beban Kantor 3.003 2.462 2.351 1.931 1.781 21,95% 4,74% 21,73% 8,44%

Office Expenses

Beban Pemeliharaan 324 260 249 239 219 24,58% 4,23% 4,31% 8,98%

Maintenance Expenses

Beban Penyusutan Aktiva 429 437 347 315 408 -1,83% 25,73% 10,16% -8,08%

Operasional

Depreciation Expenses of

Operational Assets

Beban Jasa Pihak Ketiga 652 166 388 376 229 292,92% -57,28% 3,34% 37,70%

Third Party Expenses

Beban Operasional Lainnya 5.189 2.654 1.349 318 293 95,54% 96,66% 324,16% 8,42%

Other operational Expenses

Jumlah Beban Operasional 18.961 13.713 11.019 8.865 7.745 38,27%* 24,46% 24,29% 14,46%

Total Operational expenses

Pendapatan (Beban) Lain-lain

Other Income (Expenses)

Laba (Rugi) Pelepasan Aktiva - 52 63 213 3 - -17,01% -70,42% 7.008,91%

Operasional

Profit (Loss) Sale of

Operational Assets

Pendapatan Lain di Luar 2. 429 2.462 2.787 2.608 1.522 -1,35% -11,66% 6,87% 71,38%

Investasi

Other Income Outside

Investment

Beban Lain di Luar Investasi (117) (5.001) (95) (325) (5.377) -97,67% 5145,46% -70,65% 93,69%

dan Operasional

Other Expenses Outside of

Investments and Operations

Jumlah Pendapatan (Beban) 2.313 (2.486) 2.755 2.497 (3.852) -193,04% -190,22% 10,35% 164,80%

Lain-lain

Total Other Income (Expenses)

Hasil Usaha Sebelum Pajak 429.759 359.550 413.596 342.023 457.845 19,53% -13,07% 20,93% -25,30%

Income Before Taxes

Pajak Penghasilan Badan 8.801 5.744 5.653 583 364 53,24% 1,61% 869,00% 60,36%

Income Tax

Hasil Usaha Setelah Pajak 420.957 353.807 407.943 341.440 457.481 18,98% -13,27% 19,48% -25,37%

Net Income After Tax

Catatan : Note:

* Peningkatan Beban Operasional di tahun 2016 meningkat * Operational Expenses increased in 2016 by 38.27%

sebesar 38,27% dibandingkan tahun 2015, hal ini lebih compared to 2015, this was mostly due to:

disebabkan karena:

- Kenaikan Beban Tenaga kerja, dengan adanya - Increases in Labor Expenses, with additional 1 Manager,

tambahan 1 Pengurus, 1 pegawai Compliance & Risk 1 Compliance & Risk employee and 1 Internal Audit

serta 1 pegawai staf Internal Audit. staff member.

- Cadangan Beban Renovasi Ruang Kantor sebesar - Reserve for Office Renovations of Rp1.45 billion OJK

Rp1,45 miliar. Beban Iuran OJK sebesar Rp2,62 miliar contribution expense of Rp2.62 billion due to Net

dikarenakan Aset Neto yang meningkat. Assets increase

22 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri