Page 400 - AR DPBM-2016--SMALL

P. 400

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

DANA PENSIUN BANK MANDIRI DANA PENSIUN BANK MANDIRI

PROGRAM PENSIUN IURAN PASTI DEFINED CONTRIBUTION PENSION PLAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO FINANCIAL STATEMENTS

(Lanjutan) (Continued)

Untuk Tahun-tahun yang Berakhir pada For the Years Ended

31 Desember 2016 dan 2015 December 31, 2016 and 2015

(Dalam Rupiah Penuh) (In Full Rupiah)

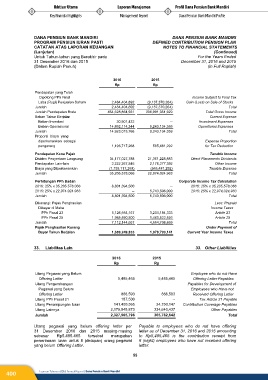

2016 2015

Rp Rp

Pendapatan yang Telah

Dipotong PPh Final Income Subject to Final Tax

Laba (Rugi) Penjualan Saham 2,484,404,892 (9,137,370,264) Gain (Loss) on Sale of Stocks

Jumlah 2,484,404,892 (9,137,370,264) Total

Jumlah Pendapatan Bruto 454,628,864,931 396,991,351,929 Total Gross Income

Beban Tahun Berjalan Current Expense

Beban Investasi 30,901,422 -- Investment Expenses

Beban Operasional 14,892,114,344 9,243,134,359 Operational Expenses

Jumlah 14,923,015,766 9,243,134,359 Total

Proporsi biaya yang

diperkenankan sebagai Expense Proportion

pengurang 1,193,717,268 565,481,292 for Tax Deduction

Pendapatan Kena Pajak Taxable Income

Dividen Penyertaan Langsung 34,177,027,788 21,361,228,883 Direct Placements Dividends

Pendapatan Lain-lain 2,222,267,546 2,178,277,392 Other Income

Biaya yang Diperkenankan (1,193,717,268) (565,481,292) Taxable Expense

Jumlah 35,205,578,066 22,974,024,983 Total

Perhitungan PPh Badan Corporate Income Tax Calculation

2016: 25% x 35.205.578.066 8,801,394,500 -- 2016: 25% x 35,205,578,066

2015: 25% x 22.974.024.983 -- 5,743,506,000 2015: 25% x 22,974,024,983

Jumlah 8,801,394,500 5,743,506,000 Total

Dikurangi: Pajak Penghasilan Less: Prepaid

Dibayar di Muka Income Taxes

PPh Pasal 23 5,126,554,167 3,204,184,333 Article 23

PPh Pasal 25 1,985,590,500 1,460,522,526 Article 25

Jumlah 7,112,144,667 4,664,706,859 Total

Pajak Penghasilan Kurang Under Payment of

Bayar Tahun Berjalan 1,689,249,833 1,078,799,141 Current Year Income Taxes

33. Liabilitas Lain 33. Other Liabilities

2016 2015

Rp Rp

Utang Pegawai yang Belum Employee who do not Have

Offering Letter 5,485,465 5,485,465 Offering Letter Payables

Utang Pengembangan Payables for Development of

Pegawai yang Belum Employees who Have not

Offering Letter 886,593 886,593 Received Offering Letter

Utang PPh Pasal 21 187,500 -- Tax Article 21 Payable

Utang Penampungan Iuran 141,400,365 24,750,147 Contribution Coverage Payables

Utang Lainnya 2,179,945,873 334,640,437 Other Payables

Jumlah 2,327,905,796 365,762,642 Total

Utang pegawai yang belum offering letter per Payable to employees who do not have offering

31 Desember 2016 dan 2015 masing-masing letter as of December 31, 2016 and 2015 amounting

sebesar Rp5.485.465 tersebut merupakan to Rp5,485,465 is the contribution receipt from

penerimaan iuran untuk 8 (delapan) orang pegawai 8 (eight) employees who have not received offering

yang belum Offering Letter. letter.

Draft / 02 Maret 2017 55 paraf:

400 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri