Page 402 - AR DPBM-2016--SMALL

P. 402

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

DANA PENSIUN BANK MANDIRI DANA PENSIUN BANK MANDIRI

PROGRAM PENSIUN IURAN PASTI DEFINED CONTRIBUTION PENSION PLAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO FINANCIAL STATEMENTS

(Lanjutan) (Continued)

Untuk Tahun-tahun yang Berakhir pada For the Years Ended

31 Desember 2016 dan 2015 December 31, 2016 and 2015

(Dalam Rupiah Penuh) (In Full Rupiah)

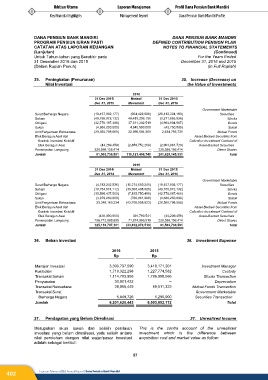

35. Peningkatan (Penurunan) 35. Increase (Decrease) on

Nilai Investasi the Value of Investments

2016

31 Des 2015/ Mutasi/ 31 Des 2016/

Dec 31, 2015 Movement Dec 31, 2016

Government Marketable

Surat Berharga Negara (19,457,902,177) (954,422,006) (20,412,324,183) Securities

Saham (49,755,072,132) 48,483,206,196 (1,271,865,936) Stocks

Obligasi (42,776,187,486) 37,811,282,519 (4,964,904,967) Bonds

Sukuk (4,688,250,000) 4,645,500,000 (42,750,000) Sukuk

Unit Penyertaan Reksadana (20,360,798,569) 22,995,594,300 2,634,795,731 Mutual Funds

Efek Beragun Aset dari Asset-Backed Securities from

Kontrak Investasi Kolektif Collective Investment Contract of

Efek Beragun Aset (44,209,459) (2,859,752,269) (2,903,961,728) Asset-Backed Securities

Penempatan Langsung 228,586,156,414 -- 228,586,156,414 Direct Shares

Jumlah 91,503,736,591 110,121,408,740 201,625,145,331 Total

2015

31 Des 2014/ Mutasi/ 31 Des 2015/

Dec 31, 2014 Movement Dec 31, 2015

Government Marketable

Surat Berharga Negara (4,183,242,936) (15,274,659,241) (19,457,902,177) Securities

Saham (10,754,574,112) (39,000,498,020) (49,755,072,132) Stocks

Obligasi (35,590,437,000) (7,185,750,486) (42,776,187,486) Bonds

Sukuk (3,979,269,000) (708,981,000) (4,688,250,000) Sukuk

Unit Penyertaan Reksadana 23,348,160,254 (43,708,958,823) (20,360,798,569) Mutual Funds

Efek Beragun Aset dari Asset-Backed Securities from

Kontrak Investasi Kolektif Collective Investment Contract of

Efek Beragun Aset (436,000,000) 391,790,541 (44,209,459) Asset-Backed Securities

Penempatan Langsung 156,712,069,895 71,874,086,519 228,586,156,414 Direct Shares

Jumlah 125,116,707,101 (33,612,970,510) 91,503,736,591 Total

36. Beban Investasi 36. Investment Expense

2016 2015

Rp Rp

Manajer Investasi 3,300,797,590 3,418,171,201 Investment Manager

Kustodian 1,719,322,298 1,227,774,582 Custody

Transaksi Saham 1,114,783,958 1,786,900,066 Stocks Transaction

Penyusutan 30,901,422 -- Depreciation

Transaksi Reksadana 28,965,449 69,511,323 Mutual Funds Transaction

Transaksi Surat Government Marketable

Berharga Negara 6,849,726 1,295,000 Securities Transaction

Jumlah 6,201,620,443 6,503,652,172 Total

37. Pendapatan yang Belum Direalisasi 37. Unrealized Income

Merupakan akun lawan dari selisih penilaian This is the contra account of the unrealized

investasi yang belum direalisasi, yaitu selisih antara investment which is the difference between

nilai perolehan dengan nilai wajar/pasar investasi acquisition cost and market value as follow:

adalah sebagai berikut:

Draft / 02 Maret 2017 57 paraf:

402 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri