Page 5 - AAG Benefits Guide OOS (Non-CA) Employees

P. 5

2021 4

BENEFITS

MEDICAL GLOSSARY

As you review your medical options, it is

important to understand the costs associated

with each plan. Your individual situation will

determine which of these costs has the most

influence on your plan selection.

Employee Contributions: Refers to the

amount you pay through payroll deductions

for the plans you choose. The Employee

Contribution amount depends on which plans

you choose and whether you are covering

dependents. Employee contributions are

ARAG deducted from your paycheck on a pre-tax

// Voluntary Legal Plan basis. Premiums for non-IRS tax dependents

will be deducted on a post-tax basis. Out-of-Pocket Maximum: This is a very

Fidelity important fact to understand. This annual

// 401(k) Deductible: This is the amount you must pay maximum limit protects you from unlimited

before the medical insurance begins to pay medical expenses. The maximum is the most

any benefits, unless the deductible is waived. you will have to pay for eligible expenses

Copay: Is a set amount you pay for a specific during the plan year. Once you meet the

service, such as an office visit out-of-pocket maximum the plan will pay

or a prescription. 100% of all eligible expenses.

Coinsurance: Some plans require that you Your Costs: Out-of-Pocket costs along with

pay a percentage of the cost of a service. your Employee Contributions comprise your

This percentage is coinsurance. total health care costs.

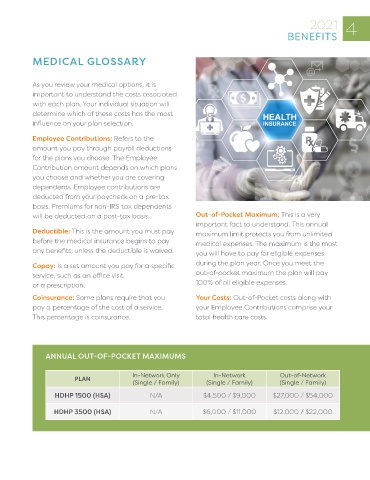

ANNUAL OUT-OF-POCKET MAXIMUMS

In-Network Only In-Network Out-of-Network

PLAN

(Single / Family) (Single / Family) (Single / Family)

HDHP 1500 (HSA) N/A $4,500 / $9,000 $27,000 / $54,000

HDHP 3500 (HSA) N/A $6,000 / $11,000 $12,000 / $22,000