Page 61 - QEB_2_2016_lowres

P. 61

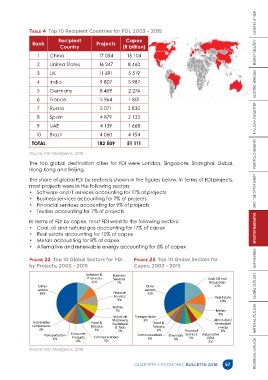

Table 4 Top 10 Recipient Countries for FDI, 2003 – 2015

Recipient Capex

Rank Projects

Country (R billion)

1 China 17 054 15 104

2 United States 16 247 8 460

3 UK 11 691 5 519

4 India 9 807 5 987

5 Germany 8 409 2 274

6 France 5 964 1 801

7 Russia 5 071 3 830

8 Spain 4 879 2 133

9 UAE 4 139 1 668

10 Brazil 4 060 4 154

TOTAL 182 509 51 111

Source: FDI Intelligence, 2016

The top global destination cities for FDI were London, Singapore, Shanghai, Dubai,

Hong Kong and Beijing.

The share of global FDI by sectors is shown in the figures below. In terms of FDI projects,

most projects were in the following sectors:

• Software and IT services accounting for 11% of projects PROVINCIAL OUTLOOK NATIONAL OUTLOOK GLOBAL OUTLOOK GAP HOUSING INVESTOR NARRATIVE SPOT THE OPPORTUNITY PORTFOLIO INSIGHTS KHULISA NEWSLETTER ELECTRIC VEHICLES ENERGY SECURITY LOOKING AT GDP

• Business services accounting for 7% of projects

• Financial services accounting for 9% of projects

• Textiles accounting for 7% of projects

In terms of FDI by capex, most FDI went to the following sectors:

• Coal, oil and natural gas accounting for 17% of capex

• Real estate accounting for 10% of capex

• Metals accounting for 8% of capex

• Alternative and renewable energy accounting for 6% of capex

Figure 22 Top 10 Global Sectors for FDI Figure 23 Top 10 Global Sectors for

by Projects, 2003 – 2015 Capex, 2003 – 2015

Software & Business

IT services Services Coal, Oil and

11% 7% Natural Gas

Other Other 17%

sectors sectors

39% Financial 33%

Services Real Estate

9% 10%

Textiles

7% Metals

8%

Industrial Transportation

Machinery, 3% Alternative/

Automative Food & Equipment Food & Renewable

components Tobacco & Tools Tobacco energy

4% 5% 5% 3% Financial 6%

Transportation Consumer Communications Communications Chemicals Services Automative

4% Products 5% 5% 5% OEM

4% 5% 5%

Source: FDI Intelligence, 2016

QUARTERLY ECONOMIC BULLETIN 2016 57