Page 23 - drive a2b may 2020

P. 23

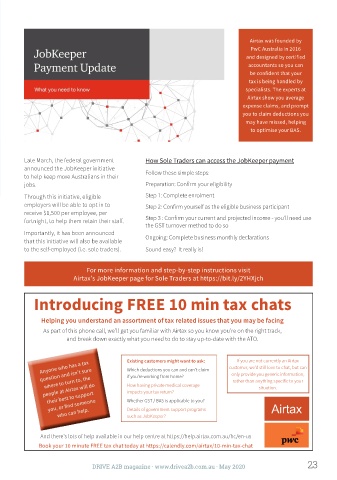

Airtax was founded by

PwC Australia in 2016

and designed by certified

accountants so you can

be confident that your

tax is being handled by

specialists. The experts at

Airtax show you average

expense claims, and prompt

you to claim deductions you

may have missed, helping

to optimise your BAS.

Late March, the federal government How Sole Traders can access the JobKeeper payment

announced the JobKeeper initiative

to help keep more Australians in their Follow these simple steps:

jobs. Preparation: Confirm your eligibility

Through this initiative, eligible Step 1: Complete enrolment

employers will be able to opt in to Step 2: Confirm yourself as the eligible business participant

receive $1,500 per employee, per

fortnight, to help them retain their staff. Step 3 : Confirm your current and projected income - you'll need use

the GST turnover method to do so

Importantly, it has been announced

that this initiative will also be available Ongoing: Complete business monthly declarations

to the self-employed (i.e. sole traders). Sound easy? It really is!

For more information and step-by-step instructions visit

Airtax's JobKeeper page for Sole Traders at https://bit.ly/2YHXjch

Introducing FREE 10 min tax chats

Helping you understand an assortment of tax related issues that you may be facing

As part of this phone call, we’ll get you familiar with Airtax so you know you’re on the right track,

and break down exactly what you need to do to stay up-to-date with the ATO.

If you are not currently an Airtax

Anyone who has a tax Existing customers might want to ask: customer, we’d still love to chat, but can

Which deductions you can and can’t claim

question and isn’t sure

only provide you generic information,

if you’re working from home?

where to turn to, the

people at Airtax will do How having private medical coverage rather than anything specific to your

situation.

impacts your tax return?

their best to support

you, or find someone Whether GST / BAS is applicable to you?

who can help. Details of government support programs

such as JobKeeper?

And there's lots of help available in our help centre at https://help.airtax.com.au/hc/en-us

Book your 10 minute FREE tax chat today at https://calendly.com/airtax/10-min-tax-chat

DRIVE A2B magazine · www.drivea2b.com.au · May 2020 23