Page 272 - International Marketing

P. 272

NPP

274 International Marketing BRILLIANT'S

5. Advance against Incentives: The government of India, extends

certain incentives to the exporters such as the Duty Drawback (DBK) ,

International Price Reimbursement Scheme (IPRS) , etc. Such incentives

are realized only after the shipment of goods and receipt of the export

proceeds. Banks offer pre-shipment as well as post-shipment finance

against such incentives.

6. Advance against Undrawn Balances: In certain lines of exports,

exporters do not draw bills for the full invoice value of goods but leave a small

part undrawn for adjustments on account of differences in rates, weight,

quality etc. Such differences can be adjusted only on the approval of goods.

Banks offer post-shipment finance against such undrawn balances.

7. Advance against Retention Money: In the case of exports of capi-

tal goods or construction contracts, the importer retains a part of the con-

tract price towards guarantee of performance or completion of the projects.

This unpaid part is known as retention money for a period of 90 days.

8. Advance against Deferred Payments: In case of exports of capital

goods or construction contracts, the exporter receives a certain portion of

the contract price as advance or down payment while the balance is re-

ceived in installments over a period of time. Banks together with the EXIM

bank offer post-shipment finance against deferred payment at a

concessional rate of interest.

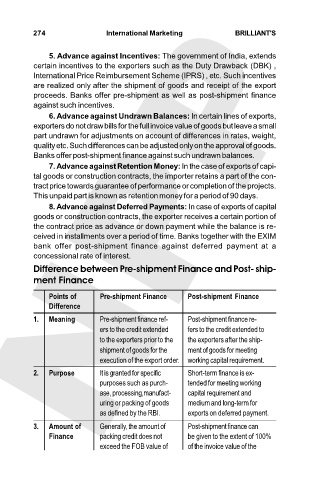

Difference between Pre-shipment Finance and Post- ship-

ment Finance

Points of Pre-shipment Finance Post-shipment Finance

Difference

1. Meaning Pre-shipment finance ref- Post-shipment finance re-

ers to the credit extended fers to the credit extended to

to the exporters prior to the the exporters after the ship-

shipment of goods for the ment of goods for meeting

execution of the export order. working capital requirement.

2. Purpose It is granted for specific Short-term finance is ex-

purposes such as purch- tended for meeting working

ase, processing,manufact- capital requirement and

uring or packing of goods medium and long-term for

as defined by the RBI. exports on deferred payment.

3. Amount of Generally, the amount of Post-shipment finance can

Finance packing credit does not be given to the extent of 100%

exceed the FOB value of of the invoice value of the