Page 117 - Corporate Finance PDF Final new link

P. 117

NPP

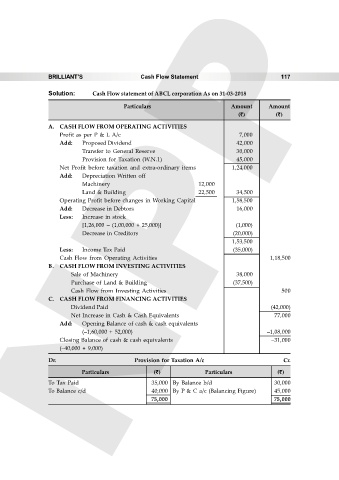

BRILLIANT’S Cash Flow Statement 117

Solution: Cash Flow statement of ABCL corporation As on 31-03-2018

Particulars Amount Amount

(`) (`)

A. CASH FLOW FROM OPERATING ACTIVITIES

Profit as per P & L A/c 7,000

Add: Proposed Dividend 42,000

Transfer to General Reserve 30,000

Provision for Taxation (W.N.1) 45,000

Net Profit before taxation and extra-ordinary items 1,24,000

Add: Depreciation Written off

Machinery 12,000

Land & Building 22,500 34,500

Operating Profit before changes in Working Capital 1,58,500

Add: Decrease in Debtors 16,000

Less: Increase in stock

[1,26,000 – (1,00,000 + 25,000)] (1,000)

Decrease in Creditors (20,000)

1,53,500

Less: Income Tax Paid (35,000)

Cash Flow from Operating Activities 1,18,500

B. CASH FLOW FROM INVESTING ACTIVITIES

Sale of Machinery 38,000

Purchase of Land & Building (37,500)

Cash Flow from Investing Activities 500

C. CASH FLOW FROM FINANCING ACTIVITIES

Dividend Paid (42,000)

Net Increase in Cash & Cash Equivalents 77,000

Add: Opening Balance of cash & cash equivalents

(–1,60,000 + 52,000) –1,08,000

Closing Balance of cash & cash equivalents –31,000

(–40,000 + 9,000)

Dr. Provision for Taxation A/c Cr.

Particulars (`) Particulars (`)

To Tax Paid 35,000 By Balance b/d 30,000

To Balance c/d 40,000 By P & C a/c (Balancing Figure) 45,000

75,000 75,000