Page 45 - FY18 Advanced Services Strategic Plan

P. 45

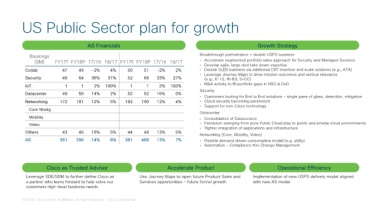

US Public Sector plan for growth

AS Financials Growth Strategy

Bookings Breakthrough performance = double USPS business

($M) FY17F FY18P 17/16 18/17 FY17F FY18P 17/16 18/17 • Accelerate segmented portfolio sales approach for Security and Managed Services

• Develop agile, large deal take down expertise

Collab 47 49 -2% 4% 50 51 -2% 2% • Double SLED business via additional CRT insertion and scale solutions (e.g., ATA)

• Leverage Journey Maps to drive mission outcomes and vertical relevance

Security 49 64 36% 31% 52 66 33% 27% (e.g., K-12, Hi-Ed, S+CC)

IoT 1 1 2% 100% 1 1 2% 100% • M&A activity to fill portfolio gaps in NSO & DoD

Security

Datacenter 49 50 14% 2% 52 52 16% 0%

• Customers looking for End to End solutions – single pane of glass, detection, mitigation

Networking 172 181 12% 5% 182 190 12% 4% • Cloud security becoming paramount

• Support for non-Cisco technology

Core Ntwkg

Datacenter

Mobility • Consolidation of Datacenters

Video • Pendulum swinging from pure Public Cloud play to public and private cloud environments

• Tighter integration of applications and infrastructure

Others 43 45 16% 5% 44 46 13% 5%

Networking (Core, Mobility, Video)

AS 361 390 14% 8% 381 406 13% 7% • Flexible demand driven consumption model (e.g. utility)

• Automation – Compliance thru Change Management

Cisco as Trusted Advisor Accelerate Product Operational Efficiency

Leverage SDE/SDM to further define Cisco as Use Journey Maps to open future Product Sales and Implementation of new USPS delivery model aligned

a partner who leans forward to help solve our Services opportunities – future funnel growth with new AS model

customers high-level business needs

© 2018 Cisco and/or its affiliates. All rights reserved. Cisco Confidential