Page 19 - business%20kit%20print%20-%20V.6%2005.11.18

P. 19

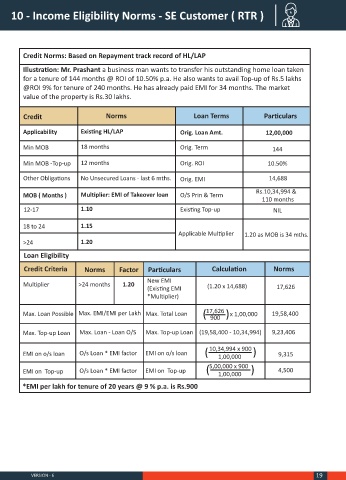

10 - Income Eligibility Norms - SE Customer ( RTR )

Credit Norms: Based on Repayment track record of HL/LAP

Illustration: Mr. Prashant a business man wants to transfer his outstanding home loan taken

for a tenure of 144 months @ ROI of 10.50% p.a. He also wants to avail Top-up of Rs.5 lakhs

@ROI 9% for tenure of 240 months. He has already paid EMI for 34 months. The market

value of the property is Rs.30 lakhs.

Credit Norms Loan Terms Particulars

Applicability Existing HL/LAP Orig. Loan Amt. 12,00,000

Min MOB 18 months Orig. Term 144

Min MOB -Top-up 12 months Orig. ROI 10.50%

Other Obligations No Unsecured Loans - last 6 mths. Orig. EMI 14,688

MOB ( Months ) Multiplier: EMI of Takeover loan O/S Prin & Term Rs.10,34,994 &

110 months

12-17 1.10 Existing Top-up NIL

18 to 24 1.15

Applicable Multiplier 1.20 as MOB is 34 mths.

>24 1.20

Loan Eligibility

Credit Criteria Norms Factor Particulars Calculation Norms

New EMI

Multiplier >24 months 1.20 (1.20 x 14,688)

(Existing EMI 17,626

*Multiplier)

Max. Loan Possible Max. EMI/EMI per Lakh Max. Total Loan ( 17,626 ( x 1,00,000 19,58,400

900

Max. Top-up Loan Max. Loan - Loan O/S Max. Top-up Loan (19,58,400 - 10,34,994) 9,23,406

EMI on o/s loan O/s Loan * EMI factor EMI on o/s loan ( 10,34,994 x 900 ( 9,315

1,00,000

EMI on Top-up O/s Loan * EMI factor EMI on Top-up ( 5,00,000 x 900 ( 4,500

1,00,000

*EMI per lakh for tenure of 20 years @ 9 % p.a. is Rs.900

VERSION - 6 19