Page 16 - business%20kit%20print%20-%20V.6%2005.11.18

P. 16

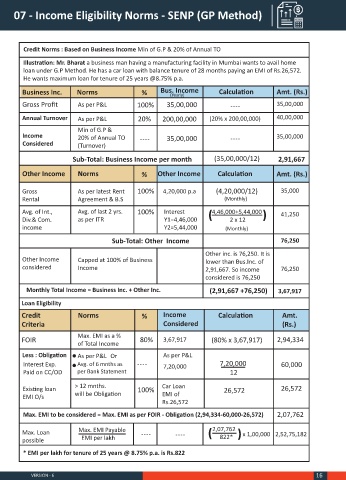

07 - Income Eligibility Norms - SENP (GP Method)

Credit Norms : Based on Business Income Min of G.P & 20% of Annual TO

Illustration: Mr. Bharat a business man having a manufacturing facility in Mumbai wants to avail home

loan under G.P Method. He has a car loan with balance tenure of 28 months paying an EMI of Rs.26,572.

He wants maximum loan for tenure of 25 years @8.75% p.a.

Business Inc. Norms % Bus. Income Calculation Amt. (Rs.)

(Yearly)

Gross Profit As per P&L 100% 35,00,000 35,00,000

Annual Turnover As per P&L 20% 200,00,000 (20% x 200,00,000) 40,00,000

Min of G.P &

Income 20% of Annual TO 35,00,000 35,00,000

Considered (Turnover)

Sub-Total: Business Income per month (35,00,000/12) 2,91,667

Other Income Norms % Other Income Calculation Amt. (Rs.)

Gross As per latest Rent 100% 4,20,000 p.a (4,20,000/12) 35,000

Rental Agreement & B.S (Monthly)

Avg. of Int., Avg. of last 2 yrs. 100% Interest ( 4,46,000+5,44,000 ( 41,250

Div.& Com. as per ITR Y1=4,46,000 2 x 12

income Y2=5,44,000 (Monthly)

Sub-Total: Other Income 76,250

Other inc. is 76,250. It is

Other Income Capped at 100% of Business lower than Bus.Inc. of

considered Income 2,91,667. So income 76,250

considered is 76,250

Monthly Total Income = Business Inc. + Other Inc. (2,91,667 +76,250) 3,67,917

Loan Eligibility

Credit Norms % Income Calculation Amt.

Criteria Considered (Rs.)

Max. EMI as a %

FOIR of Total Income 80% 3,67,917 (80% x 3,67,917) 2,94,334

Less : Obligation As per P&L Or As per P&L

Interest Exp. Avg. of 6 mnths as 7,20,000 7,20,000 60,000

Paid on CC/OD per Bank Statement 12

> 12 mnths. Car Loan

Existing loan 100% 26,572 26,572

EMI O/s will be Obligation EMI of

Rs.26,572

Max. EMI to be considered = Max. EMI as per FOIR - Obligation (2,94,334-60,000-26,572) 2,07,762

2,07,762

Max. Loan Max. EMI Payable ( 822* ( x 1,00,000 2,52,75,182

possible EMI per lakh

* EMI per lakh for tenure of 25 years @ 8.75% p.a. is Rs.822

VERSION - 6 16