Page 13 - business%20kit%20print%20-%20V.6%2005.11.18

P. 13

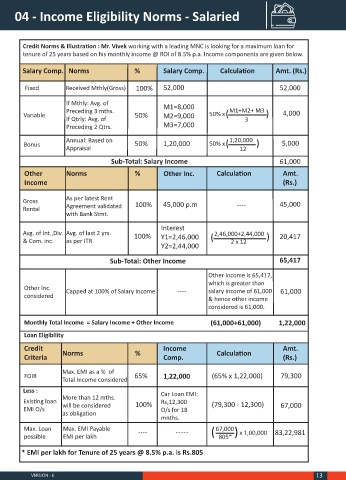

04 - Income Eligibility Norms - Salaried

Credit Norms & Illustration : Mr. Vivek working with a leading MNC is looking for a maximum loan for

tenure of 25 years based on his monthly income @ ROI of 8.5% p.a. Income components are given below.

Salary Comp. Norms % Salary Comp. Calculation Amt. (Rs.)

Fixed Received Mthly(Gross) 100% 52,000 52,000

If Mthly: Avg. of M1=8,000

Preceding 3 mths. 50% x( M1+M2+ M3 ( 4,000

Variable 50% M2=9,000

If Qtrly: Avg. of 3

Preceding 2 Qtrs. M3=7,000

Annual: Based on 50% x( 1,20,000

Bonus 50% 1,20,000 ( 5,000

Appraisal 12

Sub-Total: Salary Income 61,000

Other Norms % Other Inc. Calculation Amt.

Income (Rs.)

Gross As per latest Rent 100% 45,000 p.m 45,000

Rental Agreement validated

with Bank Stmt.

Interest

Avg. of Int.,Div. Avg. of last 2 yrs. 100% Y1=2,46,000 ( 2,46,000+2,44,000 ( 20,417

& Com. inc. as per ITR 2 x 12

Y2=2,44,000

Sub-Total: Other Income 65,417

Other income is 65,417,

which is greater than

Other Inc. Capped at 100% of Salary Income salary income of 61,000 61,000

considered & hence other income

considered is 61,000.

Monthly Total Income = Salary Income + Other Income (61,000+61,000) 1,22,000

Loan Eligibility

Credit Income Amt.

Criteria Norms % Comp. Calculation (Rs.)

Max. EMI as a % of

FOIR 65% 1,22,000 (65% x 1,22,000) 79,300

Total Income considered

Less : Car Loan EMI:

More than 12 mths.

Existing loan will be considered 100% Rs,12,300 (79,300 - 12,300) 67,000

EMI O/s O/s for 18

as obligation

mnths.

Max. Loan Max. EMI Payable ( 67,000 ( x 1,00,000 83,22,981

possible EMI per lakh 805*

* EMI per lakh for Tenure of 25 years @ 8.5% p.a. is Rs.805

VERSION - 6 13