Page 16 - AR_NorthSuburbs_Mobile

P. 16

Measuring Fairness in Assessments

There are many ways to analyze assessment quality. Upon taking office in 2018, Assessor Kaegi

committed to measuring our work against the industry standards of uniformity, set by the

International Association of Assessing Officers (IAAO).

The IAAO defines three standards that must be met to reach the standard for high-quality

assessments: accuracy, uniformity, and equity.

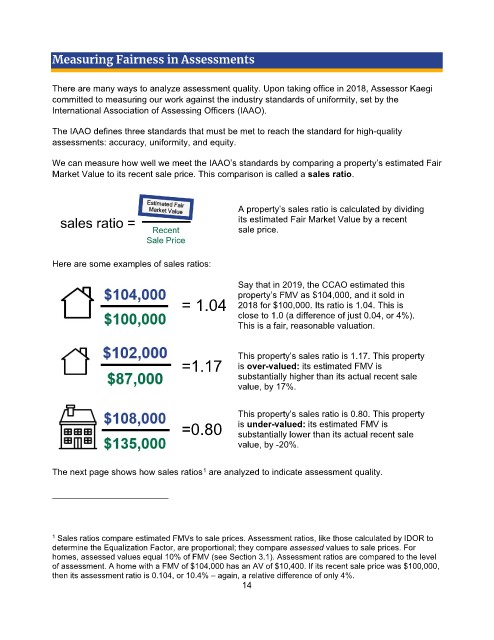

We can measure how well we meet the IAAO’s standards by comparing a property’s estimated Fair

Market Value to its recent sale price. This comparison is called a sales ratio.

A property’s sales ratio is calculated by dividing

its estimated Fair Market Value by a recent

sale price.

Here are some examples of sales ratios:

Say that in 2019, the CCAO estimated this

property’s FMV as $104,000, and it sold in

= 1.04 2018 for $100,000. Its ratio is 1.04. This is

close to 1.0 (a difference of just 0.04, or 4%).

This is a fair, reasonable valuation.

This property’s sales ratio is 1.17. This property

=1.17 is over-valued: its estimated FMV is

substantially higher than its actual recent sale

value, by 17%.

This property’s sales ratio is 0.80. This property

=0.80 is under-valued: its estimated FMV is

substantially lower than its actual recent sale

value, by -20%.

The next page shows how sales ratios are analyzed to indicate assessment quality.

1

1 Sales ratios compare estimated FMVs to sale prices. Assessment ratios, like those calculated by IDOR to

determine the Equalization Factor, are proportional; they compare assessed values to sale prices. For

homes, assessed values equal 10% of FMV (see Section 3.1). Assessment ratios are compared to the level

of assessment. A home with a FMV of $104,000 has an AV of $10,400. If its recent sale price was $100,000,

then its assessment ratio is 0.104, or 10.4% – again, a relative difference of only 4%.

14