Page 17 - AR_NorthSuburbs_Mobile

P. 17

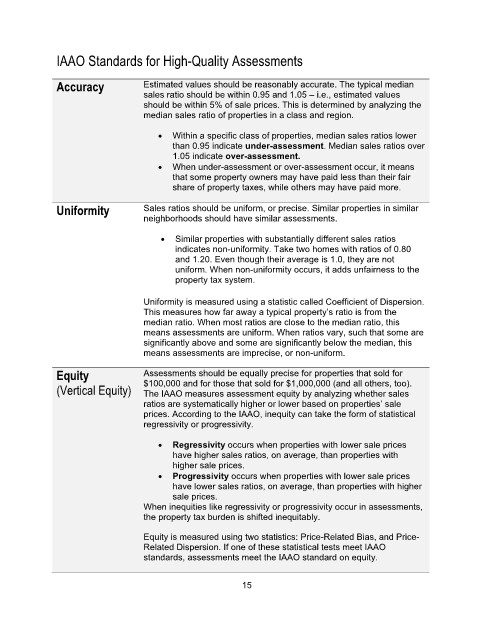

IAAO Standards for High-Quality Assessments

Accuracy Estimated values should be reasonably accurate. The typical median

sales ratio should be within 0.95 and 1.05 – i.e., estimated values

should be within 5% of sale prices. This is determined by analyzing the

median sales ratio of properties in a class and region.

• Within a specific class of properties, median sales ratios lower

than 0.95 indicate under-assessment. Median sales ratios over

1.05 indicate over-assessment.

• When under-assessment or over-assessment occur, it means

that some property owners may have paid less than their fair

share of property taxes, while others may have paid more.

Uniformity Sales ratios should be uniform, or precise. Similar properties in similar

neighborhoods should have similar assessments.

• Similar properties with substantially different sales ratios

indicates non-uniformity. Take two homes with ratios of 0.80

and 1.20. Even though their average is 1.0, they are not

uniform. When non-uniformity occurs, it adds unfairness to the

property tax system.

Uniformity is measured using a statistic called Coefficient of Dispersion.

This measures how far away a typical property’s ratio is from the

median ratio. When most ratios are close to the median ratio, this

means assessments are uniform. When ratios vary, such that some are

significantly above and some are significantly below the median, this

means assessments are imprecise, or non-uniform.

Equity Assessments should be equally precise for properties that sold for

(Vertical Equity) $100,000 and for those that sold for $1,000,000 (and all others, too).

The IAAO measures assessment equity by analyzing whether sales

ratios are systematically higher or lower based on properties’ sale

prices. According to the IAAO, inequity can take the form of statistical

regressivity or progressivity.

• Regressivity occurs when properties with lower sale prices

have higher sales ratios, on average, than properties with

higher sale prices.

• Progressivity occurs when properties with lower sale prices

have lower sales ratios, on average, than properties with higher

sale prices.

When inequities like regressivity or progressivity occur in assessments,

the property tax burden is shifted inequitably.

Equity is measured using two statistics: Price-Related Bias, and Price-

Related Dispersion. If one of these statistical tests meet IAAO

standards, assessments meet the IAAO standard on equity.

15