Page 39 - AR_NorthSuburbs_Mobile

P. 39

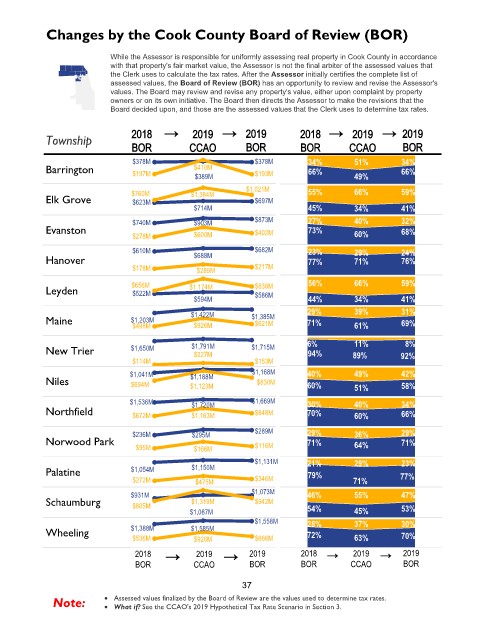

Changes by the Cook County Board of Review (BOR)

While the Assessor is responsible for uniformly assessing real property in Cook County in accordance

with that property's fair market value, the Assessor is not the final arbiter of the assessed values that

the Clerk uses to calculate the tax rates. After the Assessor initially certifies the complete list of

assessed values, the Board of Review (BOR) has an opportunity to review and revise the Assessor's

values. The Board may review and revise any property's value, either upon complaint by property

owners or on its own initiative. The Board then directs the Assessor to make the revisions that the

Board decided upon, and those are the assessed values that the Clerk uses to determine tax rates.

2018 → 2019 → 2019 2018 → 2019 → 2019

Townshi p

BOR CCAO BOR BOR CCAO BOR

$378M $378M 34% 51% 34%

Barrington $197M $410M $193M 66% 49% 66%

$389M

$1,021M 55% 66% 59%

$760M

Elk Grove $623M $1,384M $697M

$714M 45% 34% 41%

$740M $903M $873M 27% 40% 32%

Evanston $402M 73% 68%

$278M $600M 60%

$610M $682M 23% 29% 24%

Hanover $688M 77% 71% 76%

$178M $285M $217M

Leyden $656M $1,174M $838M 56% 66% 59%

$522M

$594M $586M 44% 34% 41%

Maine $1,203M $1,422M $1,385M 29% 39% 31%

71%

69%

$621M

61%

$498M

$926M

New Trier $1,650M $1,791M $1,715M 6% 11% 8%

94%

$227M

$114M $153M 89% 92%

$1,041M $1,188M $1,168M 40% 49% 42%

Niles $694M $1,123M $830M 60% 51% 58%

$1,536M $1,720M $1,669M 30% 40% 34%

Northfield $672M $1,163M $848M 70% 60% 66%

$236M $295M $289M 29% 36% 29%

Norwood Park 71% 71%

$95M $166M $116M 64%

$1,131M 21% 29% 23%

Palatine $1,054M $1,150M 79%

$272M $475M $346M 71% 77%

$931 M $1,073M 46% 55% 47%

Schaumburg $805 M $1,319M $942M

$1,087M 54% 45% 53%

$1,558M 28% 37% 30%

Wheeling $1,388M $1,585M

$536M $920M $666M 72% 63% 70%

2018 → 2019 → 2019 2018 → 2019 → 2019

BOR CCAO BOR BOR CCAO BOR

37

Note: • Assessed values finalized by the Board of Review are the values used to determine tax rates.

• What if? See the CCAO's 2019 Hypothetical Tax Rate Scenario in Section 3.