Page 37 - AR_NorthSuburbs_Mobile

P. 37

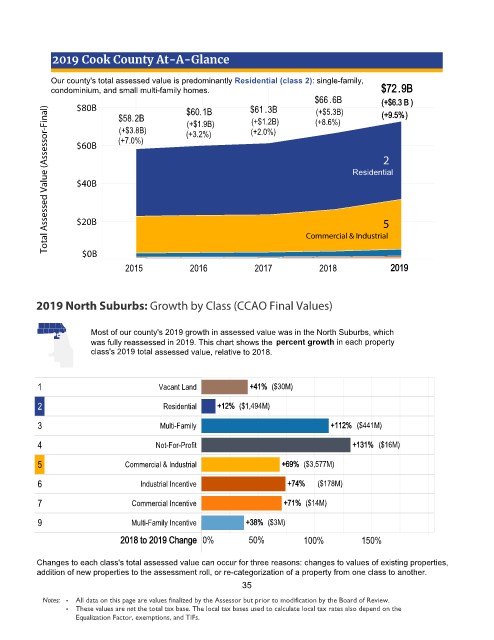

2019 Cook County At-A-Glance

Our county's total assessed value is predominantly Residential (class 2): single-family,

condominium, and small multi-family homes. $72 .9B

$66 .6B (+$6.3 B )

$80B $60.1B $61 .3B (+$5.3B)

Total Assessed Value (Assessor-Final)

$58.2B (+$1.9B) (+$1.2B) (+8.6%) (+9.5% )

(+$3.8B) (+3.2%) (+2.0%)

(+7.0%)

$60B

2

Residential

$40B

$20B 5

Commercial & Industrial

$0B

2015 2016 2017 2018 2019

2019 North Suburbs: Growth by Class (CCAO Final Values)

Most of our county's 2019 growth in assessed value was in the North Suburbs, which

was fully reassessed in 2019. This chart shows the percent growth in each property

class's 2019 total assessed value, relative to 2018.

1 Vacant Land +41% ($30M)

2 Residential +12% ($1,494M)

3 Multi-Family +112% ($441M)

4 Not-For-Profit +131% ($16M)

5 Commercial & Industrial +69% ($3,577M)

6 Industrial Incentive +74% ($178M)

7 Commercial Incentive +71% ($14M)

9 Multi-Family Incentive +38% ($3M)

2018 to 2019 Change 0% 50% 100% 150%

Changes to each class's total assessed value can occur for three reasons: changes to values of existing properties,

addition of new properties to the assessment roll, or re-categorization of a property from one class to another.

35

s • All data on this page are values finalized by the Assessor but prior to modification by the Board of Review.

• These values are not the total tax base. The local tax bases used to calculate local tax rates also depend on the

Equalization Factor, exemptions, and TIFs.