Page 32 - AR_NorthSuburbs_Mobile

P. 32

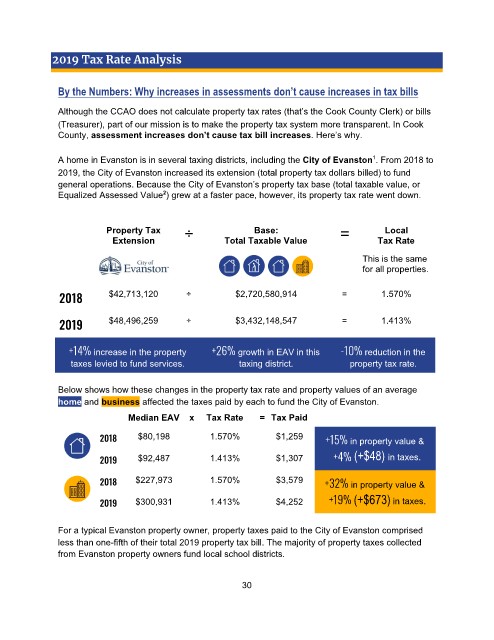

2019 Tax Rate Analysis

By the Numbers: Why increases in assessments don’t cause increases in tax bills

Although the CCAO does not calculate property tax rates (that’s the Cook County Clerk) or bills

(Treasurer), part of our mission is to make the property tax system more transparent. In Cook

County, assessment increases don’t cause tax bill increases. Here’s why.

1

A home in Evanston is in several taxing districts, including the City of Evanston . From 2018 to

2019, the City of Evanston increased its extension (total property tax dollars billed) to fund

general operations. Because the City of Evanston’s property tax base (total taxable value, or

Equalized Assessed Value ) grew at a faster pace, however, its property tax rate went down.

2

Property Tax ÷ Base: = Local

Extension Total Taxable Value Tax Rate

This is the same

for all properties.

2018 $42,713,120 ÷ $2,720,580,914 = 1.570%

2019 $48,496,259 ÷ $3,432,148,547 = 1.413%

+14% increase in the property +26% growth in EAV in this -10% reduction in the

taxes levied to fund services. taxing district. property tax rate.

Below shows how these changes in the property tax rate and property values of an average

home and business affected the taxes paid by each to fund the City of Evanston.

Median EAV x Tax Rate = Tax Paid

2018 $80,198 1.570% $1,259 +15% in property value &

2019 $92,487 1.413% $1,307 +4% (+$48) in taxes.

2018 $227,973 1.570% $3,579 +32% in property value &

2019 $300,931 1.413% $4,252 +19% (+$673) in taxes.

For a typical Evanston property owner, property taxes paid to the City of Evanston comprised

less than one-fifth of their total 2019 property tax bill. The majority of property taxes collected

from Evanston property owners fund local school districts.

30