Page 29 - AR_NorthSuburbs_Mobile

P. 29

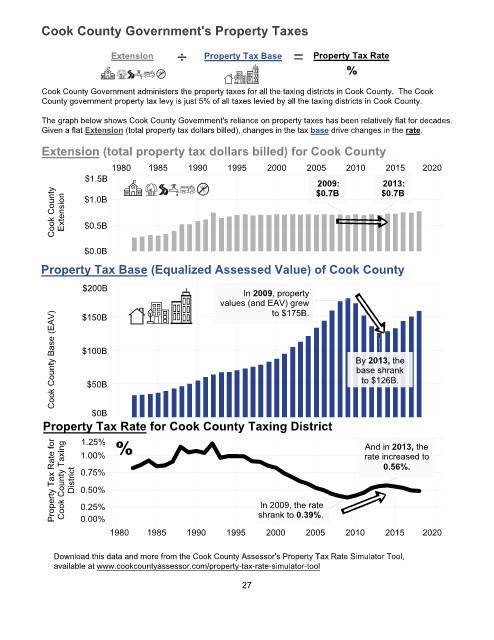

Cook County Government's Property Taxes

Extension ÷ Property Tax Base = Property Tax Rate

%

Cook County Government administers the property taxes for all the taxing districts in Cook County. The Cook

County government property tax levy is just 5% of all taxes levied by all the taxing districts in Cook County.

The graph below shows Cook County Government's reliance on property taxes has been relatively flat for decades.

Given a flat Extension (total property tax dollars billed), changes in the tax base drive changes in the rate.

Extension (total property tax dollars billed) for Cook County

1980 1985 1990 1995 2000 2005 2010 2015 2020

$1.5B 2009: 2013:

o on y ut C n o E t ni es $1.0B $0.7B $0.7B

C ok x $0.5B

$0.0 B

Property Tax Base (Equalized Assessed Value) of Cook County

$200

B

In 2009, property

values (and EAV) grew

) to $175B.

V $150

B

ae (A E s

B

utB $100 By 2013, the

o on y C $50 base shrank

to $126B.

B

C ok

B

$0

Property Tax Rate for Cook County Taxing District And in 2013, the

rpr a a e f r t R PoetT x y ai utT x o on y C irt t c Dsi 1.00% rate increased to

%

1.25%

g

o

n

0.56%.

0.75%

0.50%

ok

In 2009, the rate

0.25%

C

0.00%

2005

1980 1985 1990 1995 shrank to 0.39%. 2010 2015 2020

2000

Download this data and more from the Cook County Assessor's Property Tax Rate Simulator Tool,

available at www.cookcountyassessor.com/property-tax-rate-simulator-tool

27