Page 35 - AR_NorthSuburbs_Mobile

P. 35

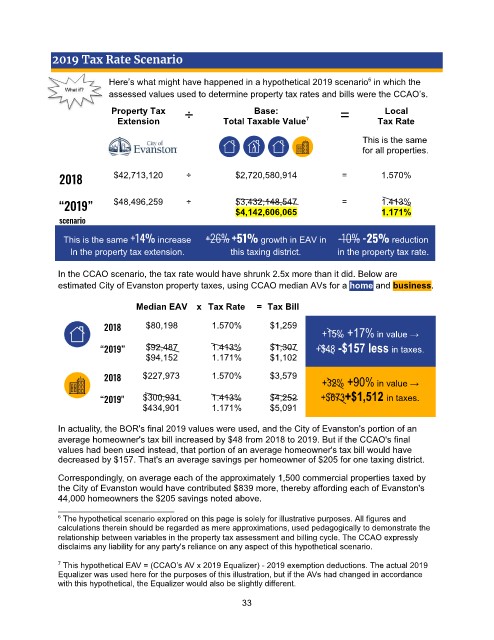

2019 Tax Rate Scenario

Here’s what might have happened in a hypothetical 2019 scenario in which the

6

assessed values used to determine property tax rates and bills were the CCAO’s.

Property Tax ÷ Base: = Local

Extension Total Taxable Value Tax Rate

7

This is the same

for all properties.

2018 $42,713,120 ÷ $2,720,580,914 = 1.570%

“2019” $48,496,259 ÷ $3,432,148,547 = 1.413%

$4,142,606,065

1.171%

scenario

This is the same +14% increase +26% +51% growth in EAV in -10% -25% reduction

In the property tax extension. this taxing district. in the property tax rate.

In the CCAO scenario, the tax rate would have shrunk 2.5x more than it did. Below are

estimated City of Evanston property taxes, using CCAO median AVs for a home and business.

Median EAV x Tax Rate = Tax Bill

2018 $80,198 1.570% $1,259

+15% +17% in value →

“2019” $92,487 1.413% $1,307 +$48 -$157 less in taxes.

$94,152 1.171% $1,102

2018 $227,973 1.570% $3,579

+32% +90% in value →

“2019" $300,931 1.413% $4,252 +$673+$1,512 in taxes.

$434,901 1.171% $5,091

In actuality, the BOR's final 2019 values were used, and the City of Evanston's portion of an

average homeowner's tax bill i ncreased by $48 from 2018 to 2019. But i f the CCAO's final

values had been used i nstead, that portion of an average homeowner's tax bill would have

decreased by $157. That's an average savings per homeowner of $205 for one taxing district.

Correspondingly, on average each of the approximately 1,500 commercial properties taxed by

the City of Evanston would have contributed $839 more, thereby affording each of Evanston's

44,000 homeowners the $205 savings noted above.

6 The hypothetical scenario explored on this page i s solely for i llustrative purposes. All figures and

calculations therein should be regarded as mere approximations, used pedagogically to demonstrate the

relationship between variables i n the property tax assessment and billing cycle. The CCAO expressly

disclaims any l iability for any party's reliance on any aspect of this hypothetical scenario.

7 This hypothetical EAV = (CCAO’s AV x 2019 Equalizer) - 2019 exemption deductions. The actual 2019

Equalizer was used here for the purposes of this i llustration, but i f the AVs had changed i n accordance

with this hypothetical, the Equalizer would also be slightly different.

33