Page 5 - Exposed Final

P. 5

Chapter One: Protect What You Already Have

The great investor, Warren Buffet, has two important rules:

Rule #1: "Don't lose money"

Rule #2: "Don't forget rule #1"

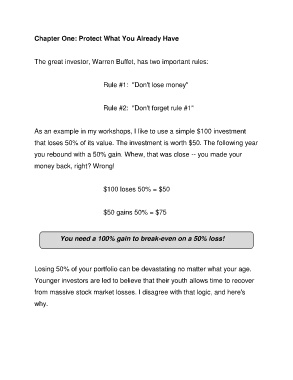

As an example in my workshops, I like to use a simple $100 investment

that loses 50% of its value. The investment is worth $50. The following year

you rebound with a 50% gain. Whew, that was close -- you made your

money back, right? Wrong!

$100 loses 50% = $50

$50 gains 50% = $75

You need a 100% gain to break-even on a 50% loss!

Losing 50% of your portfolio can be devastating no matter what your age.

Younger investors are led to believe that their youth allows time to recover

from massive stock market losses. I disagree with that logic, and here's

why.