Page 80 - Pay'n Save Retirement Truat fund

P. 80

SOUND RETIREMENT | 78

Your Standard Reduced Meat Plan pension benefit is equal to the

regular pension benefit you would be eligible to receive at age 65

based on what you earned through June 30, 2014 (excluding any

benefits transferred to the Consolidated Plan), actuarially reduced

for your age when you begin receiving payments. This amount is

then adjusted for the form of payment you select.

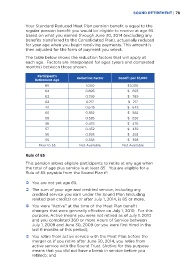

The table below shows the reduction factors that will apply at

each age. Factors are interpolated for ages (years and completed

months) between those shown.

Participant’s

Retirement Age Reduction Factor Benefit per $1,000

65 1.000 $1,000

64 0.893 $ 893

63 0.799 $ 799

62 0.717 $ 717

61 0.645 $ 645

60 0.582 $ 582

59 0.526 $ 526

58 0.476 $ 476

57 0.432 $ 432

56 0.393 $ 393

55 0.358 $ 358

Prior to 55 Not Available Not Available

Rule of 85

This pension allows eligible participants to retire at any age when

the total of age plus service is at least 85. You are eligible for a

Rule of 85 payable from the Sound Plan if:

You are not yet age 65,

The sum of your age and credited service, including any

credited service you earn under the Sound Plan (including

related plan credits) on or after July 1, 2014, is 85 or more,

You were “Active” at the time of the Meat Plan benefit

changes that were generally effective on July 1, 2010. For this

purpose, Active means you were not retired as of July 1, 2010

and you completed 360 or more Hours of Service between

July 1, 2008 and June 30, 2009 (or you were first hired in the

last 6 months of this period);

You retire from active service with the Meat Plan before the

merger or, if you retire after June 30, 2014, you retire from

active service with the Sound Trust. (Active for this purpose

means that you did not have a break in service before you

retired); and