Page 319 - ACCESS BANK ANNUAL REPORTS_eBook

P. 319

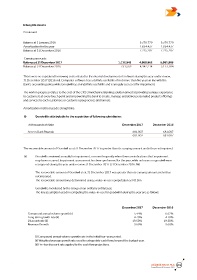

Intangible Assets

Continued

Balance at 1 January 2016 - 5,370,770 5,370,770

Amortization for the year - 1,854,437 1,854,437

Balance at 31 December 2016 - 7,225,207 7,225,207

Carrying amounts

Balance at 31 December 2017 1,112,943 4,868,962 5,981,905

Balance at 31 December 2016 231,569 4,942,214 5,173,784

There were no capitalised borrowing costs related to the internal development of software during the year under review,

31 December 2017 (2016: nil). Computer software has a definite useful life of not more than five years in line with the

Bank’s accounting policy, while Goodwill has an indefinite useful life and is annually assessed for impairment.

The work in progress relates to the cost of the CR2 Omnichannel Banking solution aimed at providing a unique experience

to customers at every touch point and empowering the bank to create, manage and deliver personalied product offerings

and services to each customers or customer group across all channels.

Amortization method used is straight line.

(i) Goodwill is attributable to the acquisition of following subsidiaries:

In thousands of Naira December 2017 December 2016

Access Bank Rwanda 681,007 681,007

681,007 681,007

The recoverable amount of Goodwill as at 31 December 2017 is greater than its carrying amount and is thus not impaired.

(ii) Goodwill is reviewed annually for impairment, or more frequently when there are indications that impairment

may have occurred. Impairment assessment has been performed for the year, while no losses on goodwill were

recognized during the year under review 31 December 2017 (31 December 2016: Nil)

The recoverable amount of Goodwill as at 31 December 2017 was greater than its carrying amount and is thus

not impaired.

The recoverable amount was determined using a value-in-use computation as N3.5bn

Goodwill is monitored by the Group on an entity by entity basis

The key assumption used in computing the value-in-use for goodwill in during the year are as follows:

December 2017 December 2016

Compound annual volume growth (i) 5.44% 6.62%

Long term growth rate (ii) 4.70% 4.70%

Discount rate (ii) 19.50% 19.50%

Revenue Growth 9.60% 9.60%

(i) Compound annual volume growth rate in the initial four-year period.

(ii) Weighted average growth rate used to extrapolate cash flows beyond the budget year.

(ii) Pre-tax discount rate applied to the cash flow projections.

Access BAnk Plc 319

Annual Report & Accounts 2017