Page 321 - ACCESS BANK ANNUAL REPORTS_eBook

P. 321

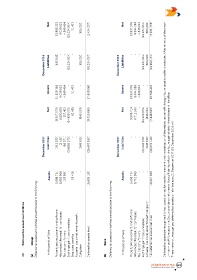

13,885,221 9,009,821 4,549,454 (29,234,934) (655,220) (2,434,237) 13,937,906 8,344,683 4,505,812 (29,234,934) (655,220) (3,101,753)

Net 11,421 - Net

December 2016 Liabilities (443,943) - - (29,234,934) - (655,220) (30,334,097) December 2016 Liabilities - - - (29,234,934) (655,220) (29,890,154)

Assets 14,329,164 9,009,821 4,549,454 - 11,421 - 27,899,860 Assets 13,937,906 8,344,683 4,505,812 - - 26,788,401

Net 63,438 Net -

(8,657,679) 8,800,508 107,409 (24,809,275) (843,619) (8,023,860) 9,508,714 8,712,969 (25,226,579) (843,619) (7,848,515)

December 2017 Liabilities (951,035) (2,460) (86,571) (24,809,275) - - (843,619) (26,690,960) December 2017 Liabilities - - - (25,226,579) (843,619) (26,070,198) Deferred tax asset are recognised for tax losses carried forward to the extent that the realisation of the related tax benefit through future taxable profits is probable. After reviews of the medi-

Assets 9,608,714 8,802,968 193,980 - 63,438 - - 18,669,100 Assets 9,508,714 8,712,969 - - - 18,221,683 um-term profit forecasts, the Group considers that there will be sufficient profits in the future against which these losses will be offset. There were no unrecognized deferred tax assets or liabilities as at 31 December 2017 (31 December 2016: nil)

Deferred tax assets and liabilities Deferred tax assets and liabilities are attributable to the following: Property and equipment, and software Allowances/(Reversal) for loan losses Exchange gain/(loss) unrealised Actuarial loss on retirement benefit Deferred tax assets and liabilities are attributable to the following: Property and equipment, and software Allowances/(Reversal) for loan losses Exchange gain/(loss) unreali

30 Group (a) In thousands of Naira Tax loss carry forward Employee benefits Obligation Deferred tax assets (net) Bank (b) In thousands of Naira Tax loss carry forward

Access BAnk Plc 321

Annual Report & Accounts 2017