Page 326 - ACCESS BANK ANNUAL REPORTS_eBook

P. 326

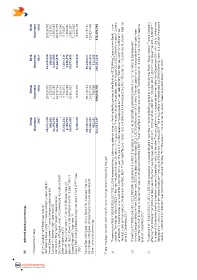

December 29,026,302 1,513,901 11,580,283 26,979,759 2,554,646 9,766,871 4,500,284 12,881,897 74,425,046 6,633,475 66,479,721 125,837,600 372,179,785

Bank 2016 -

December 26,418,938 989,655 8,045,056 21,842,579 17,641,231 2,186,572 10,975,439 6,260,348 65,230,347 122,585,415 115,561 282,291,141

Bank 2017 - -

Group December 2016 29,026,302 1,513,901 11,580,283 26,979,759 2,554,646 9,766,871 4,500,284 12,881,897 - 6,633,475 66,479,721 125,837,600 1,788,968 299,543,707

Group December 2017 28,575,578 989,655 14,479,796 41,880,625 - 17,641,231 2,186,572 10,975,439 - 6,260,348 65,230,347 122,585,415 812,181 311,617,187

The amount of N26,418,938,000 (USD 79,815,524) represents the outstanding balance in the on-lending facility granted to the Bank by AFDB (Africa Development Bank) in two tranches. The first tranche of USD35 million has matured and was fully paid out in August 2016. The second tranche was disbursed in August 2014 (USD 90m) for a year of 10years, while the third tranche came in June 2016 for (USD 10m)

The amount of N989,654,959 (USD 2,989,894) represents the outstanding balance in the on-lending facility granted to the Bank by the Netherlands Development tranche, 4.06% for the third tranche and 4.57% for the fourth tranche. From this creditor, the bank has nil undrawn balance as at 31 December 2017.

Interest bearing borrowings African Development Bank (see note (a)) Netherlands Development Finance Company (see note (b)) French Development Finance Company (see note (c)) European Investment Bank (see note (d)) International Finance Corporation (see note (e)) Central Bank of Nigeria under the Commercial Agriculture Credit Bank of Industry-Intervention Fund for SMEs (see note (g)) Bank of Industry-Power & Airline Intervention Fund (see note (h)) Acc

36 In thousands of Naira Scheme (see note (f)) note (j) (a) (b) (c)

326 Access BAnk Plc

Annual Report & Accounts 2017