Page 328 - ACCESS BANK ANNUAL REPORTS_eBook

P. 328

(l) The amount of N122,585,415,103 represents the outstanding balance on the excess crude account loans

granted to the bank by the Central Bank of Nigeria for onward disbursements to state governments.

The facility has a tenor of 20 years with a 2% interest payable to the CBN. The Bank is under obligation to

on-lend to the states at an all-in interest rate of 9% per annum. From this creditor, the bank has nil undrawn

balance as at 31 December 2017.

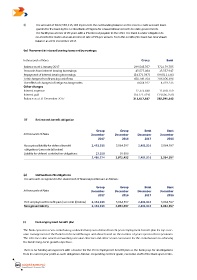

(m) Movement in interest bearing loans and borrowings:

In thousands of Naira Group Bank

Balance as at 1 January 2017 299,543,707 372,179,785

Proceeds from interest bearing borrowings 43,577,454 13,337,947

Repayment of interest bearing borrowings (34,371,397) (99,011,336)

Total changes from financing cash flows 308,749,764 286,506,396

The effect of changes in foreign exchange rates 4,664,912 4,319,235

Other changes

Interest expense 12,373,830 11,070,759

Interest paid (14,171,319) (19,605,250)

Balance as at 31 December 2017 311,617,187 282,291,140

37 Retirement benefit obligation

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Recognised liability for defined benefit 2,481,916 3,064,597 2,481,916 3,064,597

obligations (see note (a) below)

Liability for defined contribution obligations 13,358 10,856 - -

2,495,274 3,075,453 2,481,916 3,064,597

(a) Defined benefit obligations

The amounts recognised in the statement of financial position are as follows:

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Post employment benefit plan (see note (i) below) 2,481,916 3,064,597 2,481,916 3,064,597

Recognised liability 2,481,916 3,064,597 2,481,916 3,064,597

(i) Post employment benefit plan

The Bank operates a non-contributory, unfunded lump sum defined benefit post employment benefit plan for top exec-

utive management of the Bank from General Manager and above based on the number of years spent in these positions.

The scheme is also aimed at rewarding executive directors and other senior executives for the contributions to achieving

the Bank’s long-term growth objectives.

There is no funding arrangement with a trustee for the Post employment benefit plan as the Bank pays for all obligations

from its current year profit as such obligations fall due. Depending on their grade, executive staff of the Bank upon retire-

328 Access BAnk Plc

Annual Report & Accounts 2017