Page 332 - ACCESS BANK ANNUAL REPORTS_eBook

P. 332

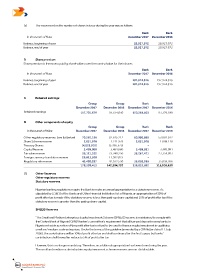

(c) The movement on the number of shares in issue during the year was as follows:

Bank Bank

In thousands of Naira December 2017 December 2016

Balance, beginning of year 28,927,972 28,927,972

Balance, end of year 28,927,972 28,927,972

B Share premium

Share premium is the excess paid by shareholders over the nominal value for their shares.

Bank Bank

In thousands of Naira December 2017 December 2016

Balance, beginning of year 197,974,816 197,974,816

Balance, end of year 197,974,816 197,974,816

C Retained earnings

Group Group Bank Bank

December 2017 December 2016 December 2017 December 2016

Retained earnings 117,701,679 93,614,030 120,218,603 93,329,188

D Other components of equity

Group Group Bank Bank

In thousands of Naira December 2017 December 2016 December 2017 December 2016

Other regulatory reserves (see i(a) below) 70,562,156 62,615,212 60,986,896 53,001,072

Share Scheme reserve 2,031,978 1,211,978 2,031,978 1,008,118

Treasury Shares (4,028,910) (3,286,375) - -

Capital Reserve 3,489,080 3,489,080 3,489,081 3,489,081

Fair value reserve 36,111,322 23,240,250 35,267,471 23,354,093

Foreign currency translation reserve 26,813,500 11,992,025 - -

Regulatory risk reserve 43,420,287 42,932,550 35,058,266 35,058,266

178,399,413 142,194,720 136,833,692 115,910,630

(i) Other Reserves

Other regulatory reserves

Statutory reserves

Nigerian banking regulations require the Bank to make an annual appropriation to a statutory reserve. As

stipulated by S.16(1) of the Banks and Other Financial Institution Act of Nigeria, an appropriation of 30% of

profit after tax is made if the statutory reserve is less than paid-up share capital and 15% of profit after tax if the

statutory reserve is greater than the paid up share capital.

SMEEIS Reserves

“The Small and Medium Enterprises Equity Investment Scheme (SMEEIS) reserve is maintained to comply with

the Central Bank of Nigeria (CBN)/ Banker’s committee’s requirement that all licensed deposit money banks in

Nigeria set aside a portion of the profit after tax in a fund to be sued to finance equity investment in qualifying

small and medium scale enterprises. Under the terms of the guideline (amended by a CBN letter dated 11 July

2006), the contributions will be 10% of profit after tax and shall continue after the first 5 years but banks’

contribution shall thereafter reduce to 5% of profit after tax

However, this is no longer mandatory. Therefore, no additional appropriation has been done during the year.

The small and medium scale industries equity invesment scheme reserves are non-distributable.

332 Access BAnk Plc

Annual Report & Accounts 2017