Page 322 - ACCESS BANK ANNUAL REPORTS_eBook

P. 322

Bank 2017 - Bank 2017 - Bank 2017

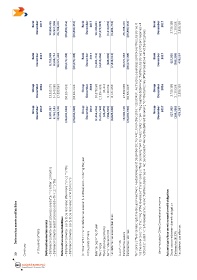

December 12,850,495 13,937,906 26,788,401 (29,890,154) (29,890,154) December 10,180,831 (12,172,525) (1,110,059) (3,101,753) 26,788,401 (29,890,154) December 3,700,198 (1,110,059) 2,590,139

Bank 2017 - Bank 2017 - Bank 2017

December 8,713,969 9,508,714 18,221,683 (26,070,198) (26,070,198) December (3,101,753) (4,558,364) (188,399) (7,848,515) 18,221,683 (26,070,198) December 627,995 (188,399) 439,597

Group December 2016 13,559,276 14,340,585 27,899,861 (30,334,096) - (30,334,096) Group December 2016 10,578,968 (11,994,559) 91,416 (1,110,059) (2,434,236) 27,899,860 (30,334,096) Group December 2016 3,700,198 (1,110,059) 2,590,139

Group December 2017 8,907,917 9,761,183 18,669,100 (26,692,960) - (26,692,960) Group December 2017 (2,434,236) (5,351,746) (49,479) (188,399) (8,023,860) 18,669,100 (26,692,960) Temporary difference relating to the Group’s Investment in subsidiaries as at December 2017 is N42.1 billion (Dec 2016: N28.6 billion). As the Group exercises control over the subsidiaries, it has the power to control the timing of the r

Deferred tax assets and liabilities – Deferred income tax asset to be recovered after more than 12 months – Deferred income tax asset to be recovered within 12 months Deferred income tax liabilities – Deferred income tax liability to be recovered after more than 12 months – Deferred income tax liability to be recovered within 12 months (c) Movement on the net defered tax assets/ (Liabilities) account during the year Net deferred tax assets/(liabilities)

Continued In thousands of Naira Deferred income tax assets In thousands of Naira Balance, beginning of year Tax charge Translation adjustments Items included in OCI Out of which Deferred tax assets Deferred tax liabilities Deferred tax @ 30% Net balance loss after tax

30

322 Access BAnk Plc

Annual Report & Accounts 2017