Page 338 - ACCESS BANK ANNUAL REPORTS_eBook

P. 338

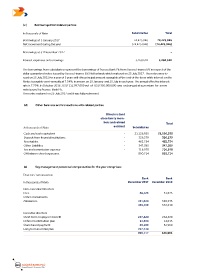

(c ) Borrowings from related parties

In thousands of Naira Subsidiaries Total

Borrowings at 1 January 2017 74,425,046 74,425,046

Net movement during the year (74,425,046) (74,425,046)

Borrowings at 31 December 2017 - -

Interest expenses on borrowings 3,268,610 3,268,610

The borrowings from subsidiaries represent the borrowings of Access Bank Plc from Access Finance BV in respect of the

dollar guaranteed notes issued by Access Finance B.V, Netherlands which matured on 25 July 2017. The notes were is-

sued on 25 July 2012 for a year of 5 years with the principal amount repayable at the end of the tenor while interest on the

Notes is payable semi-annually at 7.34%, in arrears on 25 January and 25 July in each year. The annual effective interest

rate is 7.79%. In October 2016 , USD 112,997,000 out of USD 350,000,000 was exchanged at a premium for a new

note issued by Access Bank Plc.

The notes matured on 25 July 2017 and it was fully redeemed.

(d) Other balances and transactions with related parties

Directors (and

close family mem-

bers and related Total

In thousands of Naira entities) Subsidiaries

Cash and cash equivalent - 21,126,935 21,126,935

Deposit from financial institutions - 326,279 326,279

Receivables - 462,754 462,754

Other Liabilities - 347,385 347,385

Fee and commission expense - 716,978 716,978

Off balance sheet exposures - 850,714 850,714

(e) Key management personnel compensation for the year comprises:

Directors’ remuneration

Bank Bank

In thousands of Naira December 2017 December 2016

Non-executive Directors

Fees 58,125 51,875

Other emoluments:

Allowances 411,044 320,335

469,169 372,210

Executive directors

Short term employee’s benefit 237,820 264,220

Defined contribution plan 14,364 14,813

Share based payment 39,189 52,960

Long term incentive plan 707,744 -

999,117 331,993

338 Access BAnk Plc

Annual Report & Accounts 2017