Page 173 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 173

• 171

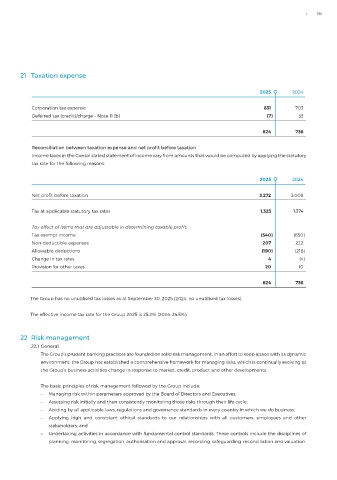

21 Taxation expense

2025 2024

Corporation tax expense 831 703

Deferred tax (credit)/charge – Note 11 (b) (7) 33

824 736

Reconciliation between taxation expense and net profit before taxation

Income taxes in the Consolidated statement of income vary from amounts that would be computed by applying the statutory

tax rate for the following reasons:

2025 2024

Net profit before taxation 3,272 3,008

Tax at applicable statutory tax rates 1,323 1,374

Tax effect of items that are adjustable in determining taxable profit:

Tax exempt income (540) (650)

Non-deductible expenses 207 222

Allowable deductions (190) (216)

Change in tax rates 4 (4)

Provision for other taxes 20 10

824 736

The Group has no unutilised tax losses as at September 30, 2025 (2024: no unutilised tax losses).

The effective income tax rate for the Group 2025 is 25.2% (2024: 24.5%).

22 Risk management

22.1 General

The Group’s prudent banking practices are founded on solid risk management. In an effort to keep apace with its dynamic

environment, the Group has established a comprehensive framework for managing risks, which is continually evolving as

the Group’s business activities change in response to market, credit, product and other developments.

The basic principles of risk management followed by the Group include:

– Managing risk within parameters approved by the Board of Directors and Executives;

– Assessing risk initially and then consistently monitoring those risks through their life cycle;

– Abiding by all applicable laws, regulations and governance standards in every country in which we do business;

– Applying high and consistent ethical standards to our relationships with all customers, employees and other

stakeholders; and

– Undertaking activities in accordance with fundamental control standards. These controls include the disciplines of

planning, monitoring, segregation, authorisation and approval, recording, safeguarding, reconciliation and valuation.