Page 171 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 171

• 169

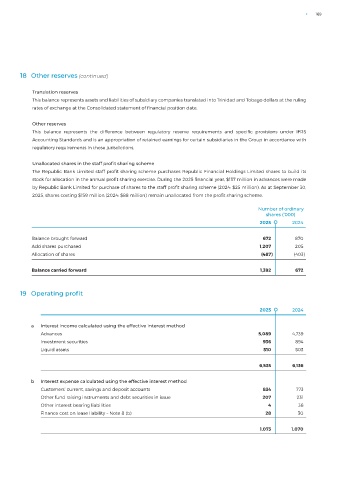

18 Other reserves (continued)

Translation reserves

This balance represents assets and liabilities of subsidiary companies translated into Trinidad and Tobago dollars at the ruling

rates of exchange at the Consolidated statement of financial position date.

Other reserves

This balance represents the difference between regulatory reserve requirements and specific provisions under IFRS

Accounting Standards and is an appropriation of retained earnings for certain subsidiaries in the Group in accordance with

regulatory requirements in those jurisdictions.

Unallocated shares in the staff profit sharing scheme

The Republic Bank Limited staff profit sharing scheme purchases Republic Financial Holdings Limited shares to build its

stock for allocation in the annual profit sharing exercise. During the 2025 financial year, $137 million in advances were made

by Republic Bank Limited for purchase of shares to the staff profit sharing scheme (2024: $25 million). As at September 30,

2025, shares costing $159 million (2024: $88 million) remain unallocated from the profit sharing scheme.

Number of ordinary

shares (’000)

2025 2024

Balance brought forward 672 870

Add shares purchased 1,207 205

Allocation of shares (487) (403)

Balance carried forward 1,392 672

19 Operating profit

2025 2024

a Interest income calculated using the effective interest method

Advances 5,089 4,739

Investment securities 936 894

Liquid assets 510 503

6,535 6,136

b Interest expense calculated using the effective interest method

Customers’ current, savings and deposit accounts 834 773

Other fund raising instruments and debt securities in issue 207 231

Other interest bearing liabilities 4 36

Finance cost on lease liability – Note 8 (b) 28 30

1,073 1,070