Page 166 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 166

164 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

10 Employee benefits (continued)

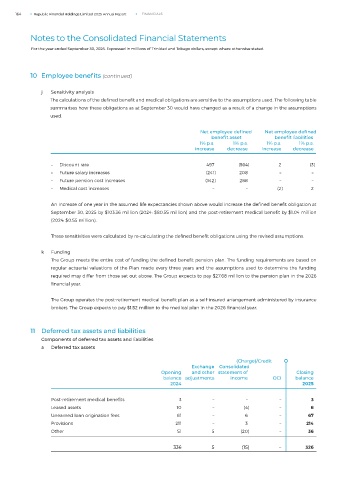

j Sensitivity analysis

The calculations of the defined benefit and medical obligations are sensitive to the assumptions used. The following table

summarises how these obligations as at September 30 would have changed as a result of a change in the assumptions

used.

Net employee defined Net employee defined

benefit asset benefit liabilities

1% p.a. 1% p.a. 1% p.a. 1% p.a.

increase decrease increase decrease

– Discount rate 497 (564) 2 (3)

– Future salary increases (241) 208 – –

– Future pension cost increases (342) 288 – –

– Medical cost increases – – (2) 2

An increase of one year in the assumed life expectancies shown above would increase the defined benefit obligation at

September 30, 2025 by $103.36 million (2024: $80.55 million) and the post-retirement medical benefit by $1.04 million

(2024: $0.55 million).

These sensitivities were calculated by re-calculating the defined benefit obligations using the revised assumptions.

k Funding

The Group meets the entire cost of funding the defined benefit pension plan. The funding requirements are based on

regular actuarial valuations of the Plan made every three years and the assumptions used to determine the funding

required may differ from those set out above. The Group expects to pay $27.68 million to the pension plan in the 2026

financial year.

The Group operates the post-retirement medical benefit plan as a self-insured arrangement administered by insurance

brokers. The Group expects to pay $1.52 million to the medical plan in the 2026 financial year.

11 Deferred tax assets and liabilities

Components of deferred tax assets and liabilities

a Deferred tax assets

(Charge)/Credit

Exchange Consolidated

Opening and other statement of Closing

balance adjustments income OCI balance

2024 2025

Post-retirement medical benefits 3 – – – 3

Leased assets 10 – (4) – 6

Unearned loan origination fees 61 – 6 – 67

Provisions 211 – 3 – 214

Other 51 5 (20) – 36

336 5 (15) – 326