Page 161 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 161

• 159

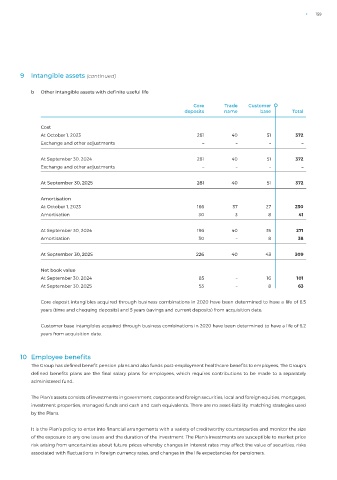

9 Intangible assets (continued)

b Other intangible assets with definite useful life

Core Trade Customer

deposits name base Total

Cost

At October 1, 2023 281 40 51 372

Exchange and other adjustments – – – –

At September 30, 2024 281 40 51 372

Exchange and other adjustments – – – –

At September 30, 2025 281 40 51 372

Amortisation

At October 1, 2023 166 37 27 230

Amortisation 30 3 8 41

At September 30, 2024 196 40 35 271

Amortisation 30 – 8 38

At September 30, 2025 226 40 43 309

Net book value

At September 30, 2024 85 – 16 101

At September 30, 2025 55 – 8 63

Core deposit intangibles acquired through business combinations in 2020 have been determined to have a life of 8.5

years (time and chequing deposits) and 5 years (savings and current deposits) from acquisition date.

Customer base intangibles acquired through business combinations in 2020 have been determined to have a life of 6.2

years from acquisition date.

10 Employee benefits

The Group has defined benefit pension plans and also funds post-employment healthcare benefits to employees. The Group’s

defined benefits plans are the final salary plans for employees, which requires contributions to be made to a separately

administered fund.

The Plan’s assets consists of investments in government, corporate and foreign securities, local and foreign equities, mortgages,

investment properties, managed funds and cash and cash equivalents. There are no asset-liability matching strategies used

by the Plans.

It is the Plan’s policy to enter into financial arrangements with a variety of creditworthy counterparties and monitor the size

of the exposure to any one issues and the duration of the investment. The Plan’s investments are susceptible to market price

risk arising from uncertainties about future prices whereby changes in interest rates may affect the value of securities, risks

associated with fluctuations in foreign currency rates, and changes in the life expectancies for pensioners.