Page 159 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 159

• 157

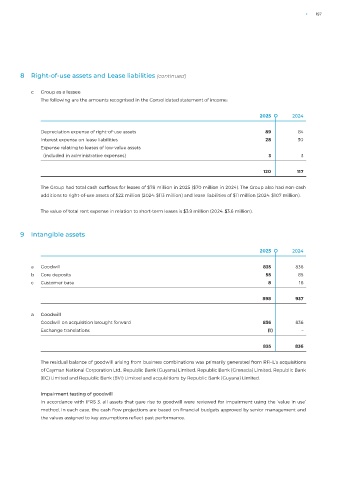

8 Right-of-use assets and Lease liabilities (continued)

c Group as a lessee

The following are the amounts recognised in the Consolidated statement of income:

2025 2024

Depreciation expense of right-of-use assets 89 84

Interest expense on lease liabilities 28 30

Expense relating to leases of low-value assets

(included in administrative expenses) 3 3

120 117

The Group had total cash outflows for leases of $78 million in 2025 ($70 million in 2024). The Group also had non-cash

additions to right-of-use assets of $22 million (2024: $113 million) and lease liabilities of $11 million (2024: $107 million).

The value of total rent expense in relation to short-term leases is $3.9 million (2024: $3.6 million).

9 Intangible assets

2025 2024

a Goodwill 835 836

b Core deposits 55 85

c Customer base 8 16

898 937

a Goodwill

Goodwill on acquisition brought forward 836 836

Exchange translations (1) –

835 836

The residual balance of goodwill arising from business combinations was primarily generated from RFHL’s acquisitions

of Cayman National Corporation Ltd., Republic Bank (Guyana) Limited, Republic Bank (Grenada) Limited, Republic Bank

(EC) Limited and Republic Bank (BVI) Limited and acquisitions by Republic Bank (Guyana) Limited.

Impairment testing of goodwill

In accordance with IFRS 3, all assets that gave rise to goodwill were reviewed for impairment using the ‘value in use’

method. In each case, the cash flow projections are based on financial budgets approved by senior management and

the values assigned to key assumptions reflect past performance.