Page 163 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 163

• 161

10 Employee benefits (continued)

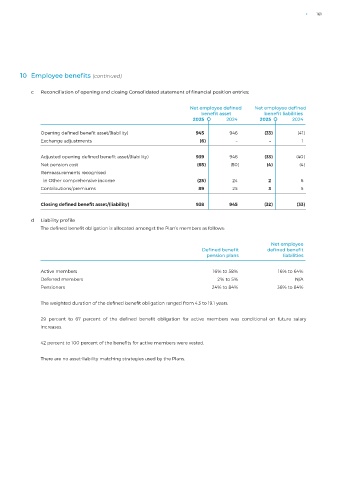

c Reconciliation of opening and closing Consolidated statement of financial position entries:

Net employee defined Net employee defined

benefit asset benefit liabilities

2025 2024 2025 2024

Opening defined benefit asset/(liability) 945 946 (33) (41)

Exchange adjustments (6) – – 1

Adjusted opening defined benefit asset/(liability) 939 946 (33) (40)

Net pension cost (65) (50) (4) (4)

Remeasurements recognised

in Other comprehensive income (25) 24 2 6

Contributions/premiums 89 25 3 5

Closing defined benefit asset/(liability) 938 945 (32) (33)

d Liability profile

The defined benefit obligation is allocated amongst the Plan’s members as follows:

Net employee

Defined benefit defined benefit

pension plans liabilities

Active members 16% to 58% 16% to 64%

Deferred members 2% to 5% N/A

Pensioners 24% to 84% 36% to 84%

The weighted duration of the defined benefit obligation ranged from 4.3 to 19.1 years.

29 percent to 67 percent of the defined benefit obligation for active members was conditional on future salary

increases.

42 percent to 100 percent of the benefits for active members were vested.

There are no asset-liability matching strategies used by the Plans.