Page 167 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 167

• 165

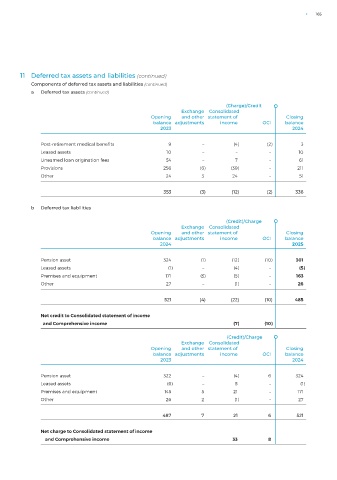

11 Deferred tax assets and liabilities (continued)

Components of deferred tax assets and liabilities (continued)

a Deferred tax assets (continued)

(Charge)/Credit

Exchange Consolidated

Opening and other statement of Closing

balance adjustments income OCI balance

2023 2024

Post-retirement medical benefits 9 – (4) (2) 3

Leased assets 10 – – – 10

Unearned loan origination fees 54 – 7 – 61

Provisions 256 (6) (39) – 211

Other 24 3 24 – 51

353 (3) (12) (2) 336

b Deferred tax liabilities

(Credit)/Charge

Exchange Consolidated

Opening and other statement of Closing

balance adjustments income OCI balance

2024 2025

Pension asset 324 (1) (12) (10) 301

Leased assets (1) – (4) – (5)

Premises and equipment 171 (3) (5) – 163

Other 27 – (1) – 26

521 (4) (22) (10) 485

Net credit to Consolidated statement of income

and Comprehensive income (7) (10)

(Credit)/Charge

Exchange Consolidated

Opening and other statement of Closing

balance adjustments income OCI balance

2023 2024

Pension asset 322 – (4) 6 324

Leased assets (6) – 5 – (1)

Premises and equipment 145 5 21 – 171

Other 26 2 (1) – 27

487 7 21 6 521

Net charge to Consolidated statement of income

and Comprehensive income 33 8