Page 165 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 165

• 163

10 Employee benefits (continued)

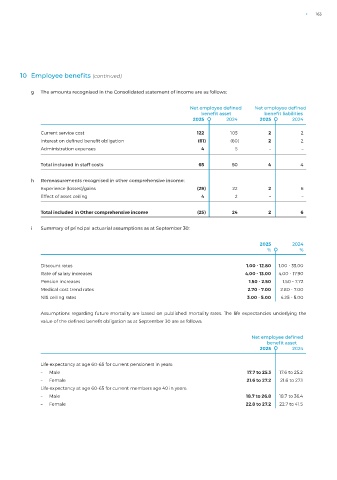

g The amounts recognised in the Consolidated statement of income are as follows:

Net employee defined Net employee defined

benefit asset benefit liabilities

2025 2024 2025 2024

Current service cost 122 105 2 2

Interest on defined benefit obligation (61) (60) 2 2

Administration expenses 4 5 – –

Total included in staff costs 65 50 4 4

h Remeasurements recognised in other comprehensive income:

Experience (losses)/gains (29) 22 2 6

Effect of asset ceiling 4 2 – –

Total included in Other comprehensive income (25) 24 2 6

i Summary of principal actuarial assumptions as at September 30:

2025 2024

% %

Discount rates 1.00 - 12.80 1.00 - 33.00

Rate of salary increases 4.00 - 13.00 4.00 - 17.90

Pension increases 1.50 - 2.50 1.50 - 7.72

Medical cost trend rates 2.70 - 7.00 2.80 - 7.00

NIS ceiling rates 3.00 - 5.00 4.25 - 5.00

Assumptions regarding future mortality are based on published mortality rates. The life expectancies underlying the

value of the defined benefit obligation as at September 30 are as follows:

Net employee defined

benefit asset

2025 2024

Life expectancy at age 60-65 for current pensioners in years:

– Male 17.7 to 25.3 17.6 to 25.2

– Female 21.6 to 27.2 21.6 to 27.1

Life expectancy at age 60-65 for current members age 40 in years:

– Male 18.7 to 26.8 18.7 to 36.4

– Female 22.8 to 27.2 22.7 to 41.5