Page 160 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 160

158 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

9 Intangible assets (continued)

a Goodwill (continued)

Impairment testing of goodwill (continued)

The impact of the global economy exacerbated by high inflation, tariffs and rising interest rates, has created uncertainty

in the estimation of cash flow projections, discount rates and terminal growth rates. The goodwill impairment tests

were conducted using sensitivity analysis, including a range of growth rates, interest rates, recovery assumptions, macro-

economic outlooks and discount rates for each entity in arriving at an expected cash flow projection.

Using these assumptions, the value in use of the CGU exceeded the carrying values.

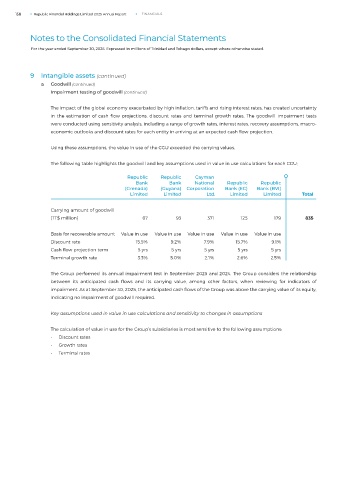

The following table highlights the goodwill and key assumptions used in value in use calculations for each CGU:

Republic Republic Cayman

Bank Bank National Republic Republic

(Grenada) (Guyana) Corporation Bank (EC) Bank (BVI)

Limited Limited Ltd. Limited Limited Total

Carrying amount of goodwill

(TT$ million) 67 93 371 125 179 835

Basis for recoverable amount Value in use Value in use Value in use Value in use Value in use

Discount rate 15.5% 9.2% 7.9% 15.7% 9.1%

Cash flow projection term 5 yrs 5 yrs 5 yrs 5 yrs 5 yrs

Terminal growth rate 3.3% 5.0% 2.1% 2.6% 2.5%

The Group performed its annual impairment test in September 2025 and 2024. The Group considers the relationship

between its anticipated cash flows and its carrying value, among other factors, when reviewing for indicators of

impairment. As at September 30, 2025, the anticipated cash flows of the Group was above the carrying value of its equity,

indicating no impairment of goodwill required.

Key assumptions used in value in use calculations and sensitivity to changes in assumptions

The calculation of value in use for the Group’s subsidiaries is most sensitive to the following assumptions:

• Discount rates

• Growth rates

• Terminal rates