Page 175 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 175

• 173

22 Risk management (continued)

22.2 Credit risk (continued)

The debt securities within the Group’s investment security portfolio are exposed to credit risk and are managed by

investment grading or country exposure with preset exposure limits as approved by the Board of Directors. The credit

quality of each individual security is assessed based on the financial strength, reputation and market position of the

issuing entity and the ability of that entity to service the debt.

The Group avoids exposure to undue concentrations of risk by placing limits on the amount of risk accepted from a

number of borrowers engaged in similar business activities, or activities in the same geographic region or with similar

economic features that would cause their ability to meet contractual obligations to be similarly affected by changes in

economic, political or other conditions. Such risks are controlled and monitored on a revolving basis and are subject to

an annual or more frequent review. Limits on the level of credit risk by product, industry sector, client and geography are

approved by the Board of Directors.

The Group’s credit control processes emphasise early detection of deterioration and prompt implementation of remedial

action and where it is considered that recovery of the outstanding balance may be doubtful or unduly delayed, such

accounts are transferred from performing to non-performing status.

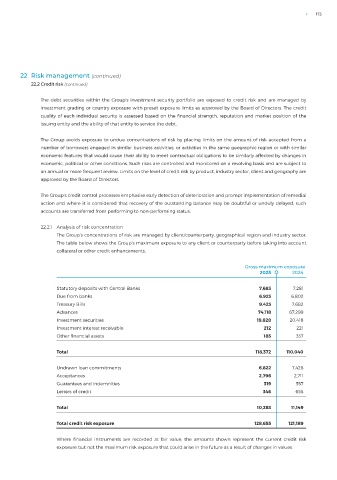

22.2.1 Analysis of risk concentration

The Group’s concentrations of risk are managed by client/counterparty, geographical region and industry sector.

The table below shows the Group’s maximum exposure to any client or counterparty before taking into account

collateral or other credit enhancements.

Gross maximum exposure

2025 2024

Statutory deposits with Central Banks 7,683 7,281

Due from banks 6,923 6,802

Treasury Bills 9,423 7,682

Advances 74,118 67,299

Investment securities 19,828 20,418

Investment interest receivable 212 221

Other financial assets 185 337

Total 118,372 110,040

Undrawn loan commitments 6,822 7,426

Acceptances 2,796 2,711

Guarantees and indemnities 319 357

Letters of credit 346 655

Total 10,283 11,149

Total credit risk exposure 128,655 121,189

Where financial instruments are recorded at fair value, the amounts shown represent the current credit risk

exposure but not the maximum risk exposure that could arise in the future as a result of changes in values.