Page 180 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 180

178 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22 Risk management (continued)

22.2 Credit risk (continued)

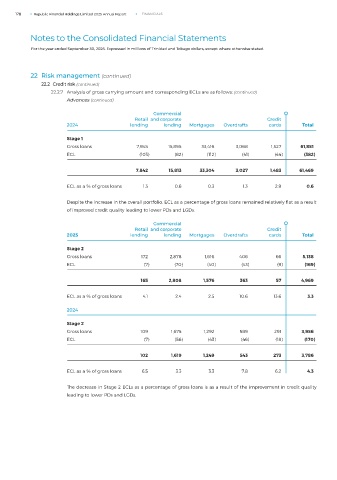

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows: (continued)

Advances (continued)

Commercial

Retail and corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Stage 1

Gross loans 7,945 15,895 33,416 3,068 1,527 61,851

ECL (103) (82) (112) (41) (44) (382)

7,842 15,813 33,304 3,027 1,483 61,469

ECL as a % of gross loans 1.3 0.6 0.3 1.3 2.9 0.6

Despite the increase in the overall portfolio, ECL as a percentage of gross loans remained relatively flat as a result

of improved credit quality leading to lower PDs and LGDs.

Commercial

Retail and corporate Credit

2025 lending lending Mortgages Overdrafts cards Total

Stage 2

Gross loans 172 2,878 1,616 406 66 5,138

ECL (7) (70) (40) (43) (9) (169)

165 2,808 1,576 363 57 4,969

ECL as a % of gross loans 4.1 2.4 2.5 10.6 13.6 3.3

2024

Stage 2

Gross loans 109 1,675 1,292 589 291 3,956

ECL (7) (56) (43) (46) (18) (170)

102 1,619 1,249 543 273 3,786

ECL as a % of gross loans 6.5 3.3 3.3 7.8 6.2 4.3

The decrease in Stage 2 ECLs as a percentage of gross loans is as a result of the improvement in credit quality

leading to lower PDs and LGDs.