Page 182 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 182

180 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22 Risk management (continued)

22.2 Credit risk (continued)

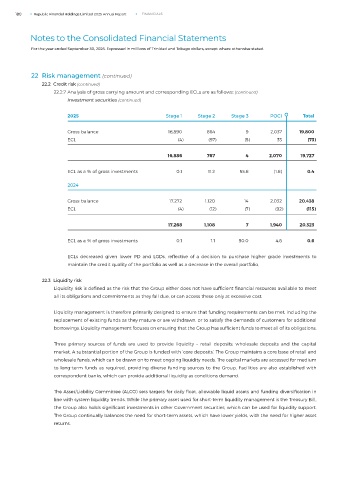

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows: (continued)

Investment securities (continued)

2025 Stage 1 Stage 2 Stage 3 POCI Total

Gross balance 16,890 864 9 2,037 19,800

ECL (4) (97) (5) 33 (73)

16,886 767 4 2,070 19,727

ECL as a % of gross investments 0.1 11.2 55.6 (1.6) 0.4

2024

Gross balance 17,272 1,120 14 2,032 20,438

ECL (4) (12) (7) (92) (115)

17,268 1,108 7 1,940 20,323

ECL as a % of gross investments 0.1 1.1 50.0 4.6 0.6

ECLs decreased given lower PD and LGDs, reflective of a decision to purchase higher grade investments to

maintain the credit quality of the portfolio as well as a decrease in the overall portfolio.

22.3 Liquidity risk

Liquidity risk is defined as the risk that the Group either does not have sufficient financial resources available to meet

all its obligations and commitments as they fall due, or can access these only at excessive cost.

Liquidity management is therefore primarily designed to ensure that funding requirements can be met, including the

replacement of existing funds as they mature or are withdrawn, or to satisfy the demands of customers for additional

borrowings. Liquidity management focuses on ensuring that the Group has sufficient funds to meet all of its obligations.

Three primary sources of funds are used to provide liquidity – retail deposits, wholesale deposits and the capital

market. A substantial portion of the Group is funded with ‘core deposits’. The Group maintains a core base of retail and

wholesale funds, which can be drawn on to meet ongoing liquidity needs. The capital markets are accessed for medium

to long-term funds as required, providing diverse funding sources to the Group. Facilities are also established with

correspondent banks, which can provide additional liquidity as conditions demand.

The Asset/Liability Committee (ALCO) sets targets for daily float, allowable liquid assets and funding diversification in

line with system liquidity trends. While the primary asset used for short-term liquidity management is the Treasury Bill,

the Group also holds significant investments in other Government securities, which can be used for liquidity support.

The Group continually balances the need for short-term assets, which have lower yields, with the need for higher asset

returns.