Page 183 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 183

• 181

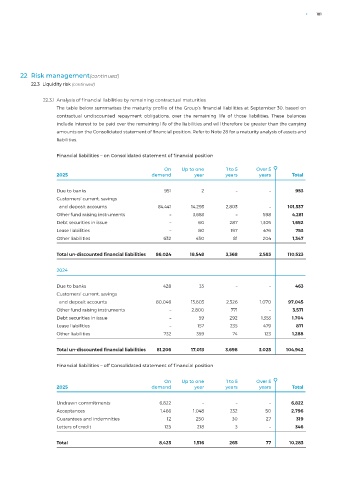

22 Risk management(continued)

22.3 Liquidity risk (continued)

22.3.1 Analysis of financial liabilities by remaining contractual maturities

The table below summarises the maturity profile of the Group’s financial liabilities at September 30, based on

contractual undiscounted repayment obligations, over the remaining life of those liabilities. These balances

include interest to be paid over the remaining life of the liabilities and will therefore be greater than the carrying

amounts on the Consolidated statement of financial position. Refer to Note 28 for a maturity analysis of assets and

liabilities.

Financial liabilities – on Consolidated statement of financial position

On Up to one 1 to 5 Over 5

2025 demand year years years Total

Due to banks 951 2 – – 953

Customers’ current, savings

and deposit accounts 84,441 14,293 2,803 – 101,537

Other fund raising instruments – 3,683 – 598 4,281

Debt securities in issue – 60 287 1,305 1,652

Lease liabilities – 80 197 476 753

Other liabilities 632 430 81 204 1,347

Total un-discounted financial liabilities 86,024 18,548 3,368 2,583 110,523

2024

Due to banks 428 35 – – 463

Customers’ current, savings

and deposit accounts 80,046 13,603 2,326 1,070 97,045

Other fund raising instruments – 2,800 771 – 3,571

Debt securities in issue – 59 292 1,353 1,704

Lease liabilities – 157 235 479 871

Other liabilities 732 359 74 123 1,288

Total un-discounted financial liabilities 81,206 17,013 3,698 3,025 104,942

Financial liabilities – off Consolidated statement of financial position

On Up to one 1 to 5 Over 5

2025 demand year years years Total

Undrawn commitments 6,822 – – – 6,822

Acceptances 1,466 1,048 232 50 2,796

Guarantees and indemnities 12 250 30 27 319

Letters of credit 125 218 3 – 346

Total 8,425 1,516 265 77 10,283